What is Non Performing Assets (NPA) ?

Meaning and Definition of Non Performing Assets (NPA)

An asset is classified as non-performing asset (NPA) if dues in the form of principal and interest are not paid by the borrower for a period of 180 days. However with effect from March 2004, default status would be given to a borrower if dues are not paid for 90 days. If any advance or credit facilities granted by bank to a borrower become non-performing, then the bank will have to treat all the advances/credit facilities granted to that borrower as non-performing without having any regard to the fact that there may still exist certain advances / credit facilities having performing status.

The Securitization Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 defined Non Performing Assets (NPAs) as "An asset or account of a borrower, which has been classified by a bank or financial institution as sub-standard, doubtful or loss assets in accordance with the direction or guidelines relating to asset classification issued by the RBI".

As per Reserve Bank of India's guidelines, income on loans is to be recognized on receipt basis (as against accrual basis) and it has not been received for a specified period, the same asset is to be treated as non performing.

Prudential Norms for Non Performing Assets Classification

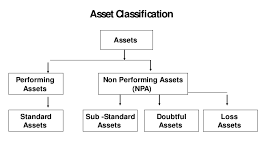

Prudential Norms of Reserve Bank of India (RBI) has issued guidelines on provisioning requirement with respect to bank advances. In terms of these guidelines, bank advances are mainly classified into :

The banks have to classify their advances into four broad categories:

1) Standard Assets/Earning Assets:

Assets which do not carry any risk which is in addition to normal risk attached to the banking business. In other words these are the assets (advances), which continue to generate income (interest) on regular basis without any default or risk. These are known as performing assets of standard assets.

2) Sub-standard Assets :

With effect from 31st March, 2005 Sub-standard assets are those assets which have been classified as NPA for a period less than or equal to twelve (12) months. In such cases the current net worth of the borrower/guarantor or the current market value of the security charged is t enough to ensure recovery of the dues (principal and interest) in full. Thus, the earlier period of 18 months has been reduced to 12 months.

3) Doubtful Assets :

With effect from 31st March, 2005 an asset would be classified as doubtful if it remained in the substandard category for twelve (12) months. Thus, the earlier period of exceeding 18 months has been reduced to 12 months.

4) Loss Assets :

Loss assets comprise assets where a loss has been identified by the bank or the RBI. These are generally considered uncollectible. Their realisable value is so low that their continuance as bankable assets is not warranted.

Management of Non Performing Assets

Non Performing Assets are the inevitable burden on the banking industry. Banks need to monitor standard assets to monitor standard assets to arrest any account becoming a Non Performing Assets. The success of banks depends upon the methods of managing NPAs and keeping them within a tolerance level. For any bank, effective NPA management is the keyword for the progress of the Bank. There are two approaches to manage NPA. They are shown in figure below :

Following are the preventive management in NPAs :

1) Credit Assessment and Risk Management Mechanism :

A lasting solution to the problem of Non Performing Assets can be achieved only with proper credit assessment and risk management mechanism. The documentation of credit policy and credit audit immediately after the sanction is necessary to upgrade the quality of credit appraisal in banks. In a situation of liquidity overhang the enthusiasm of the banking system is to increase lending with compromise on asset quality, raising concern about adverse selection and potential danger of addition to the NPAs stock. It is necessary that the banking system is equipped with prudential norms to minimize if not completely avoid the problem of credit risk.

2) Organizational Restructuring :

With regard to internal factors leading to NPAs the onus for containing the same rest with the bank themselves. These will necessities organizational restructuring improvement in the managerial efficiency, skill up gradation for proper assessment of credit worthiness and a change in the attitude of the banks towards legal action, which is traditionally viewed as a measure of the last resort.

3) Reduce Dependence on Interest :

The Indian banks are largely depending upon lending and investments. The banks in the developed countries do not depend upon this income whereas 86 per cent of income of Indian banks is accounted from interest and the rest of the income is fee based. The banker can cam sufficient net margin by investing in safer securities though not at high rate of interest. It facilitates for limiting of high level of NFAs gradually. It is possible that average yield on loans and advances net default provisions and services costs do not exceed the average yield on safety securities because of the absence of risk and service cost.

4) Potential and Borderline NPAS under Check :

The potential and borderline accounts require quick diagnosis and remedial measures so that they do not step into Non Performing Assets categories. The auditors of the banking companies must monitor all outstanding accounts in respect of accounts enjoying credit limits beyond cut off points, so that new sub-standard assets can be kept under check.

Curative Management

The curative measures are designed to maximize recoveries so that banks funds locked up in NPAs are released for recycling. The Central Government and RBI have taken steps for arresting incidence of fresh Non Performing Assets and creating legal and regulatory environment to facilitate the recovery of existing NPAs of banks. They are:

1) Debt Recovery Tribunals (DRT) :

In order to expedite speedy disposal of high value claims of banks Debt Recovery Tribunals were setup. The Central Government has amended the recovery of debts due to banks and financial institutions Act in January 2000 for enhancing the effectiveness of DRTs. The provisions for placement of more than one recovery officer, power to attach dependents property before judgment, penal provision for disobedience of Tribunals order and appointment of receiver with powers of realization. management, protection and preservation of property are expected to provide necessary teeth to the DRTs and speed up the recovery of NPAs in times to come.

2) Lok Adalats :

The Lok Adalats institutions help banks to settle disputes involving accounts in doubtful and loss categories. These are proved to be an effective institution for settlement of dues in respect of smaller loans. The Lok Adalats and Debt Recovery Tribunals have been empowered to organize Lok Adalats to decide for NPAs of Rs.10 lacs and above.

3) Asset Reconstruction Company (ARC) :

The Narasimham Committee on financial system (1991) has recommended for setting up of Asset Reconstruction Funds (ARF). The following concerns were expressed by the committee.

- It was felt that centralized all India fund will severely handicap in its recovery efforts by lack widespread geographical reach which individual bank posses, and

- Given the large fiscal deficits, there will be a problem of financing the ARF.

Subsequently, the Narasimham committee on banking sector reforms has recommended for transfer of sticky assets of banks to the ARC. Thereafter the Varma committee on restructuring weak public sector banks has also viewed the separation of Non Performing Assets and its transfer thereafter to the ARF is an important element in a comprehensive restructuring strategy for weak banks. This enables a one time clearing of balance sheet of banks by sticky loans.

4) Corporate Debt Restructuring (CDR) :

The corporate debt restructuring is one of the methods suggested for the reduction of NPA. objective is to ensure a timely and transparent mechanism for restructure of corporate debts of viable corporate entities.

Prudential Norms for Capital Adequacy

Capital Adequacy Norms RBI : The traditional approach to sufficiency of capital does not capture the risk elements in various types of assets in the balance sheet as well as in the off-balance sheet business and compare the capital to the level of the assets.

Norms for Capital Adequacy Ratio in India

The Committee on Banking Regulations and Supervisory Practices (Basel Committee) had released the guidelines on capital measures and capital standards in July 1988 which were been accepted by Central Banks in various countries including RBI. In India it has been implemented by RBI w.e.f. 1.4.92

The fundamental objective behind the norms is to strengthen the soundness and stability of the banking system. It is ratio of capital fund to risk weighted assets. It is a measure of a bank's capital. It is expressed as a percentage of a bank's risk weighted credit exposures.

CAR = Tier one capital + Tier two capital

-----------------------------------------

Risk weighted assets

This ratio is used to protect depositors and promote the stability and efficiency of financial systems around the world.

A new capital framework was introduced for Indian scheduled commercial banks based on the Basle Committee recommendations presenting two tiers of capital for the banks:

- Tier I or core capital, considered the most permanent and readily available support against unexpected losses, includes paid-up capital, statutory reserves, share premium and capital reserve; and

- Tier II capital consisting of undisclosed reserves, fully paid-up cumulative perpetual preference shares revaluation reserves, general provisions and loss reserves, etc.

- It was also prescribed that Tier II capital should not be more than 100 per cent of Tier I capital.

Minimum requirements of capital fund in India :

- Existing Banks 09%,

- New Private Sector Banks 10%,

- Banks undertaking Insurance business 10%

- Local Area Banks 15%

Tier I Capital should at no point of time be less than 50% of the total capital. This implies that Tier II cannot be more than 50% of the total capital.