- Meaning of SEBI.

- Establishment and Management of SEBI.

- Background and Need of SEBI.

- Functions of SEBI.

- Powers of SEBI.

- Changes Introduced by SEBI in Capital Market.

- Regulatory Aspects of SEBI.

- Achievement of SEBI.

What is Securities and Exchange Board of India (SEBI) ?

Securities and Exchange Board of India (SEBI) is a statutory regulatory body entrusted with the responsibility to regulate the Indian capital markets. It monitors and regulates the securities market and protects the interests of the investors by enforcing certain rules and regulations. During the decade of 1980s, the Indian stock market grew by leaps and bounds. The growth of the stock market necessitated the existence of a controlling agency. The Securities Exchange Commission in America serves as a watch dog over the function of the stock market in USA. Considering the stock market development in India, the Government decided to set up a controlling authority and thus, SEBI or Securities Exchange Board of India was established on 12th April 1988 and given Statutory Powers on 30 January 1992 through the SEBI Act, 1992.

What is the Reason for "Establishment and Management of SEBI" ?.

Establishment and Management of SEBI :

A fair and efficient securities market plays an important role in a country's efforts towards industrialization. It directly affects mobilization and efficient channelizing of savings of the household sector into productive enterprise. The securities market encourages thrift and risk taking. It helps enterprises to raise money in a cost effective manner. There was a spectacular growth in the securities market. In the same way there was also a growth in the awareness of and interest in investment opportunities available in the securities market among lay savers. The was a need to sustain this growth and crystalize the awareness and interest the rights must be fully protected, trading malpractices must be prevented. Therefore, the government felt the need of setting up, a statutory apex board to promote orderly and healthy growth of the securities market for investor protection.

A) Establishment :

The establishment of the Securities and Exchange Board of India (SEBI) was a land mark government measure to monitor and regulate capital market activities and to promote healthy development of the market. On the suggestions of the high powered committee on stock exchange reforms, namely the G.S. Patel Committee, the Government of India step up the Securities and Exchange Board of India (SEBI) on April 12, 1988. The chairmanship of the board was entrusted to Dr. S.A.Dave, the executive Director of IDBI. The other members of the Board were nominated by the Government. They were drawn from professional brokers, financial consultants, merchant bankers, investors, stock exchange authorities, Finance Ministry, etc. It was made a statutory body by the Securities and Exchange Board of India Act, 1992.

B) Management :

Section 4 of the above Act lays down the constitution of the management of SEBI. The Board of members of SEBI shall consist of a chairman, two members from amongst the officials of the Ministries of the Central Government dealing with finance and law, one member from amongst the officials of the RBI, two members to be appointed by the central Government, who shall be professionals and interalia have experience or special knowledge relating to securities market. The general superintendence, direction and management of the affairs of the Board shall vest in a Board of Members, which may exercise all powers and do all acts which may be exercised or done by that Board.

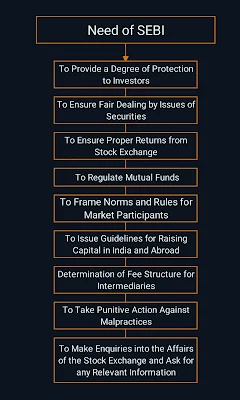

Need of Securities and Exchange Board of India (SEBI) :

There was an urgent need to have a regulating authority in order to check the malpractices on the part of issuers of securities, merchant banker, brokers and dealers, etc.

The need to have the Securities Exchange Board of India was felt because of following reasons :

It is a healthy sign if there is a steady flow of savings of investors into the securities market. At the same time, the investors rights and interests must be safeguarded. Investors are always interested in receiving returns on their investments by assuring safety and liquidity to their investments. SEBI sees to it that there are no malpractices on the part of any concerned agency so that the investor is not short circulated. SEBI has recently uncovered many seams whereby ordinary investors are taken for a ride. For example, the existence of multiple D-MAT accounts in Ahmedabad, insider trading of many securities in BSE and NSE, etc.

2) To Ensure Fair Dealings by Issues of Securities :

It was found essential that issuers of various securities were cheating the investing public. It was recently found that many fictitious companies were being formed to dupe thousands of innocent investors. The need for SEBI therefore was acutely felt by honest companies who wanted to raise finance in the right way.

3) To Ensure Proper Returns from Stock Exchange :

There was a necessity to have an agency to whom stock exchanges should report their activities regularly. SEBI fulfilled this need.

4) To Make Enquiries into the Affairs of the Stock Exchange and Ask for any Relevant Information :

It was felt that the Government must intervene into the affairs of the stock exchanges in case of doubtful dealings and ask for relevant information to make enquiries. The Government could do this now with the setting up of SEBI.

5) To Regulate Mutual Funds :

With the proliferation of a large number of mutual funds in India, the Government thought it necessary to have an authority which would regulate mutual funds and ensure proper control on liquidity in the economy. SEBI is meant to cover the working of mutual funds.

6) To Frame Norms and Rules for Market Participants :

An authority was required to be set up to frame norms and rules for various market participants such as corporate bodies, brokers, agents, banks, mutual funds etc. SEBI was thus to according entrusted the job of forming various norms and rules not only for local participants but also foreign investors.

7) To Issue Guidelines for Raising Capital in India and Abroad :

A separate agency was required to issue guidelines for new companies wanting to raise funds, pricing various issues, underwriting, making adequate disclosures, etc.

8) Determination of Fee Structure for Intermediaries:

There was no proper regulation of fees charged by various brokers, middlemen and banks who acted as intermediaries for trading in securities. An agency was therefore required so that a proper fee structure could be set up for different services offered by different market participants.

9) To Take Punitive Action Against Malpractices :

Many financial scams went into litigation earlier and no action was taken for years together. However, an agency which could dispense fast justice in such cases was a necessity of the times. SEBI is authorized to take certain punitive actions to curb such activities.

Above explains the need for SEBI in India.

What are the Functions of SEBI ?

SEBI seeks to create an environment which would facilitate mobilization of adequate resources through the securities market and its efficient allocation. SEBI plays an important role as a controlling authority and a development institution.

Major Functions of SEBI :

SEBI performs various functions to achieve its objectives. These functions are given below:

1) Creation of Proper and Conductive Atmosphere :

It is the function of the SEBI to create a proper and conductive atmosphere required for raising money from the capital market. The atmosphere includes the rules, regulations, trade practices, customs and relations among institutions, brokers, investors and companies. It has to endeavour to restore the trust of investors and particularly safeguard the interest of the small investors. This can be achieved by meeting the needs of the persons connected with the secunues market and establishing proper co-ordination among the three main groups directly connected with its operations. They are investors, corporate sector and intermediaries.

2) Investors Education :

It is the function of SEBI to educate investors and make them aware of their rights in clear and specific terms. It shall provide investors with formation and see that the market maintains liquidity, safety and profitability of the securities which are crucial for any investment.

3) Creation of Proper Investment Climate :

SEBI has to create proper investment climate to enable corporate sector to raise industrial securities easily, efficiently and at affordable minimum cost.

4) Making of Effective Laws :

It is the main function of the SEBI to devise laws with unified set of objectives, single administrative authority and an integrated framework to deal with all the aspects of the securities market. It has to make law-making and observance flexible enough to suit the prevailing market conditions and circumstances. It will ensure that the rules are versatile and non-rigid to provide automatic and self regulatory growth.

5) Development of Proper Infrastructure :

SEBI has to develop a proper infrastructure so that market automatically facilitates expansion and growth of business of middlemen like brokers, jobbers, commercial banks, merchant bankers, mutual funds, etc. Thus, it will ensure that they provide efficient service to their constituents, namely, investors and corporate sector at competitive price.

6) Creation of Framework :

SEBI has to create the framework for more open, orderly and unprejudiced conduct in relation to takeover and mergers in the corporate sector. It is to be done to ensure fair and equal treatment to all security holders and to facilitate such takeovers and mergers in the interest of efficiency by prescribing a mechanism for more orderly conduct.

7) Authoritative Institution :

It has to work as an authoritative institution to see that the intermediaries are financially sound and equipped with professional and competent manpower.

8) Establishment of Effective Inspection Machinery :

SEBI has to establish an effective inspection machinery which is expected to act like an umpire. It will provide to its players timely guidance, encouragement and incentives as well as impose upon them a self discipline to observe the rules of the game.

9) Prohibition of Malpractices :

It is the function of the SEBI to prohibit the malpractices prevailing in market such as insider trading, kerb trading, shares cornering, unreasonable delay in effecting share transfer by companies. The Board works as an authority to execute such provision and it will be responsible to ensure that they really work effectively.

What are the Powers of the SEBI ?

The SEBI Act casts upon SEBI the duty to protect the interests of investors in securities and to promote the development of and to regulate the securities market through appropriate measure. To fulfill this duty SEBI is given certain powers. These powers are given below:

Powers of SEBI :

1) Power to Make Regulations :

The Board has the power to make regulations in respect of -

- The business in stock exchanges and any other securities market.

- The working of stock-brokers, sub-brokers, share transfer agents, bankers to an issue, trustees of trust deeds, registrars to an issue, merchant bankers, underwriters, portfolio managers, investment advisors and such other intermediaries who may be associated with securities market in any manner.

- The working of collective investment schemes, including mutual funds.

- Substantial acquisition of shares and take-over of companies.

2) Government Powers to SEBI :

The Government has concurrently delegated to SEBI most of its powers under the securities contracts (Regulation) Act, 1956, for ensuring more effective protection of the interest of the investors and creating an efficient and well regulated stock market. Finance ministry and SEBI will continue to exercise dual jurisdiction.

3) Power of Recognition of Stock Exchanges :

The SEBI has following powers in respect of recognition of stock exchanges :

- It has the power relating to the submission of applications for the recognition of stock exchanges.

- It has the power relating to grant of recognition of stock exchanges.

- It has the power to withdraw the recognition of a stock exchange.

4) Power to make or Amend Rules :

The SEBI has the power to make or amend rules of articles of association of a stock exchange regarding voting rights to members of a stock exchange at any meeting.

5) Power to Call for Information :

It has the power to call for information from undertaking inspection, conducting enquiries and audits of the stock exchanges and intermediaries and self-regulatory organisations in the securities market.

6) Power for Penalizing :

SEBI has been given powers for penalizing failure to furnish information and returns, for which a person can be fined up to Rs. 1.50 lakhs. SEBI has given powers to penalize intermediaries for not entering into agreements and failure to redress grievance. Mutual funds can also be penalized for default including non- registration and failure to observe rules and regulations by an asset management company. Government has empowered SEBI to penalize brokers for non-issue of contract notes, non-delivery of shares and charging excess brokerage. Market intermediaries can be fined up to Rs. Five lakhs for indulging in insider trading. Similar penalties will also be attracted for non-disclosure of acquisition of shares and takeovers.

7) Powers to Issue Directions :

SEBI has power to issue directions to all intermediaries and persons associated with the securities market with a view to protecting investors or securing the orderly development of the securities market.

8) Power to File Complaints :

SEBI has been empowered to file complaints in courts without the prior approval of the central government and to notify its regulations without the prior approval of the central government. This has reinforced SEBI's autonomy and enable it to respond speedily to changing market conditions.

Changes Introduced by SEBI in Capital Market :

4) The task of giving approvals to Fil registrations was handed over to SEBI in 2003. In order to discourage Fil investments made through P-notes, SEBI has imposed sufficient checks and balances to avoid the flow of black money into the Indian markets.

5) Strict vigil on usage of IPO issue proceeds, greater disclosure by companies and their bankers and allotment of a minimum number of shares to retail investors. Keeping with the times, SEBI has also introduced e-IPO procedure for electronic bidding in public offers to help investors bid for shares in a cost-effective manner.

6) In 1996-97, SEBI directed all exchanges to fix the daily price band at 10% and a weekly overall limit of 25% to curb undesirable volatility. To bring about a coordinated trading halt in all equity and derivatives market nationwide, SEBI introduced an index based circuit breaker system applicable at 10%, 15% and 20% movement either way.

7) SEBI has a web-based centralized grievance redress system called SEBI Complaints Redress System - SCORES for assisting investors to lodge their complaints in a structured way.

8) NB: International Organisation of Securities Commissions-IOSCO under its Financial Sector Assessment Program - FSAP acknowledged that the comprehensive risk management framework prescribed by SEBI is one of the pillars of the Indian securities settlement system.

9) SEBI distinguishes itself from other regulators in India as it is a financially independent regulator with its own sources of revenue.

Regulatory Aspects of Securities Exchange Board of India (SEBI) :

Regulatory Departments :

India's financial markets are regulated by the Securities and Exchange Board of India (SEBI). SEBI is the regulatory authority established under Section 3 of the Securities and Exchange Board of India Act in 1992 to:

a) Protect the interests of investors in'securities.

b) Promote the development of India's securities markets.

c) Regulate the securities markets. Besides the act that created SEBI, several other government acts, including two enacted before the creation of SEBI, help SEBI meet its objectives and exercise its powers. These include the:

iii) Companies Act 1956

SEBI Regulates Securities Market Activities Through Four Departments :

1) Market intermediaries Registration and Supervision Department (MIRSD) :

The MIRSD oversees the registration, supervision, compliance monitoring, and inspection of all market intermediaries for all segments of the market, including equity, derivatives, and debt.

2) Market Regulation Department (MRD) :

The MRD is responsible for formulating new policies and supervising the operation of securities exchanges, their subsidiaries, and market institutions such as clearing and settlement organizations and depositories for al instruments except derivatives.

3) Derivatives and New Products Departments (DNPD) :

The DNPD approves the creation and introduction of new derivative products and supervises trading for derivative operations of the stock exchanges.

4) Integrated Surveillance Department :

The Integrated Surveillance Department monitors the activities of the cash, and futures and options markets and generates detailed reports at the end of each day concerning such issues as the identity of the most active scrip's, clients, and brokers. The department monitors market movements, analyzes abnormal trading patterns, and, if suspecting that something is amiss, initiates appropriate action. Rigorous risk management methodology is used by the stock exchanges and SEBI's four departments to regulate securities market activities.

Regulatory Framework under SEBl :

The four main legislations governing the securities market are :

a) The SEBI Act, 1992 which establishes SEBI to protect investors and develop and regulate securities market;

b) The Companies Act, 1956, which sets out the code of conduct for the corporate sector in relation to issue, allotment and transfer of securities, and disclosures to be made in public issues;

c) The Securities Contracts (Regulation) Act, 1956, which provides for regulation of transactions in securities through control over stock exchanges;

d) The Depositories Act, 1996 which provides for electronic maintenance and transfer of ownership of demat securities.

e) Government has framed rules under the SCRA, SEBI Act and the Depositories Act. SEBI has framed regulations under the SEBI Act and the Depositories Act for registration and regulation of all market intermediaries, and for prevention of unfair trade practices, insider trading, etc.

Under these Acts, Government and SEBI issue notifications, guidelines, and Circulars which need to be complied with by market participants. The SROs like stock exchanges have also laid down their rules of game. The responsibility for regulating the securities market is shared by Department of Economic Affairs (DEA), Department of Company Affairs (DCA), Reserve Bank of India (RBI) and SEBI. The activities of these agencies are coordinated by the High Level Committee on Capital Markets. Most of the powers under the SCRA are exercisable by DEA while a few others by SEBI. The powers of the DEA under the SCRA are also con-currently exercised by SEBI. The powers in respect of the contracts for sale and purchase of securities, gold related securities, money market securities and securities derived from these securities and ready forward contracts in debt securities are exercised concurrently by RBI.

The SEBI Act and the Depositories Act are mostly administered by SEBI. The rules and regulations under the securities laws are administered by SEBI. The powers under the Companies Act relating to issue and transfer of securities and non-payment of dividend are administered by SEBI in case of listed public companies and public companies proposing to get their securities listed.

The SROs ensure compliance with their own rules as well as with the rules. SEBI also has two advisory committees for primary and secondary market, to provide advisory inputs in framing policies and regulations. These committees are constituted from among the market players, recognized investor associations and eminent persons associated with capital markets. These committees are non-statutory and their advice is only recommendatory in nature.

Achievements of the SEBI :

The important achievements of the SEBI are enumerated below :

1) The SEBI has made some regulation for proper disclosure to investors through prospectus. SEBI has made it obligatory to disclose the information through prospectus.

2) SEBI has issued guidelines for merchant bankers.

3) It also has provided advertising code for mutual funds.

4) SEBI has made it obligatory for the mutual funds to publish balance sheets.

5) It has formulated takeover.code.

6) It has drafted guidelines on share transfer agents and registrars to an issue.

7) It has issued portfolio management service guidelines.

8) It has issued drafted guidelines on insider training.

9) It has introduced stock invest scheme to eliminate delayed refunds.

10) It has persuaded Bombay Stock Exchange to pass a resolution admitting corporate members.

11) It has proposed that the exchanges take a percentage of the issue amount as deposit from companies seeking listing.

12) It has made BSE to publicize outstanding trading position on some scrips.

13) It has suggested detailed brokerage/commission in contract notes.

14) It has registered a number of investor associations.

15) It has setup self-regulatory organisations like the Association of Merchant Bankers of India.

16) It has issued a draft regulation for substantial acquisition of shares in listed companies.

17) After the abolition of CCI, the SEBI issued new guidelines on capital issues, opening up the capital market to free pricing of issues.

18) It has made underwriting compulsory for all public issues.

19) It has prepared and circulated a detailed note on a draft legislation to prevent insider trading to all bodies for their comments.

20) It has registered intermediaries associated with the securities market. They include the following :

i) Regards to an issue, share Transfer Agents or both.ii) Bankers to the issue.iii) Trustees to the Debenture Trust Deeds (schedules banks, public financial institutions, insurance companies or bodies corporate).iv) Underwriters other than merchant bankers holding authorization from SEBI.v) Portfolio managers other than merchant bankers holding authorization from SEBI in categories I and II.vi) Investment advisers (only persons carrying on such activities for specific fee or charge, other than merchant bankers holding authorization from SEBI.