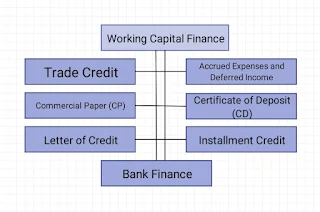

- Sources of Working Capital Financing.

- Trade Credit : Advantages and Disadvantages.

- Accrued Expenses and Deferred Income.

- Commercial Paper (CP) : Features, Advantages and Disadvantages.

- Certificate of Deposit : Advantages and Disadvantages.

- Letter of Credit (LC) : Advantages and Disadvantages.

- Installment Credit : Advantages and Disadvantages.

- Bank Finance : Forms of Bank Finance.

What are the Sources of Working Capital Financing ?

The level of working capital requirements varies from industry to industry, within one industry and from one company to another. However, there is a direct relationship between the size of a business enterprise and its working capital needs; they are generally in direct proportion. In other words, larger the size of a business enterprise, higher would be its working capital requirements and smaller the size of a business enterprise, lower would be its working capital requirements. Similarly, working capital requirements are generally at a higher level in the case of manufacturing units then the level of the units engaged in trading business.

There are a number of options available for a company to rise working capital finance. Some of such sources are described in the following points :

Trade Credit is an arrangement between two consenting parties (generally a buyer and a seller/supplier), under which goods and services are provided by the seller / supplier without making prompt cash payment by the buyer, on a condition to make payment within an agreed time period.

Advantages of Trade Credit :

Trade credit is the simplest form of raising working capital finance with following advantages :

1) Easy Availability :

Trade credit is easy to avail by the buyer and easy to extend by the supplier/seller, as compared to the other forms of raising finance. It is used as a common practice amongst financially sound business organisations, almost automatic and generally does not involve any negotiations. It is of specific significance for smaller business entities, which find it rather difficult to enter capital market for raising finance, due to their size and capabilities.

2) Flexibility :

The level of trade credit is dynamic and variable in accordance with the changes in the level of business of the buyer. If the business of a buyer grows, the trade credit is automatically increased by the supplier. On the other hand, if there is a decline in the business of the buyer, its purchases would be reduced and the trade credit will also be cut short in the same ratio.

3) Informality :

Under the trade credit arrangement, any formalities relating to negotiations or agreement, etc. is not required. I is free from all constraints, which are essential components of negotiated sources of finance. It is characterised by its simplicity, ease, and informality.

Disadvantage of Trade Credit :

The salient disadvantage of "Trade Credit' is high cost of goods and services demanded by the suppliers and lack of cash discount, which is available otherwise.

2) Accrued Expenses and Deferred Income :

The 'Accrued Expenses' as well as the 'Deferred Income' are liabilities of a company and acts as a short- term source of finance.

Accrued expenses are the expenses, which a business organisation owes to others (individual or another business organisation), but have not been paid as they have not yet become due. They are liability for a company, as they arise due to the goods or services, which are already availed by the company. The payment against such supply of goods or services would require to be made when the same becomes due, which is a future date. This is an automatic and interest free source of short-term finance. Salaries, wages, interest, and taxes are some of the example of 'Accrued Expenses'. These components of Accrued Expenses are shown in the company's annual balance sheet as salaries accrued, wages accrued, interest accrued and taxes payable respectively. These expenses become due for payments on monthly, quarterly, half yearly or yearly basis. All such items of expenses act as a short term source of finance for a company.

The advantage of accrued expenses as a source of short-term finance 1st that they are interest free. Disadvantage of such type of short-term finance is the limitations imposed by legal, contractual, and practical considerations.

Deferred incomes are incomes received in advance by a business organisation for the supply of goods or services at some future date. They are basically liabilities for an organisation. However, they are not only a source of short-term finance; they also enhance the liquidity level of the organisation. Such items (deferred income) are shown in the balance-sheet as 'Income Received in Advance'.

Advance payment can be demanded by companies having following features :

1) Companies enjoying monopoly in the area of their operations.2) Products and services of a specific company are in great demand.3) The company is in the business of manufacturing of a special product on a specific order.

3) Commercial Paper (CP) :

Commercial Paper (CP) is a 'Money Market' financial instrument issued by large-sized corporate bodies to raise short-term funds to meet their temporary requirement. This is an unsecured instrument supported by the promise of the issuer or his banker for the payment of the face value on the due date specified on the paper. Since CP is not supported by any collateral, only big companies enjoying high level of goodwill and credit rating are capable of raising funds through this route at reasonable rates.

Features of Commercial Paper :

Main features of CP are as follows :

1) Duration :

CP can be issued for maturities ranging between seven days to one year.

2) Repayment :

The repayment of CP is required to be race made necessarily on the specified maturity date without delay. There is no provision for 'Grace Period'. However, in case of the maturity date being a holiday, repayment needs to be effected on the immediately preceding working day.

3) Renewal :

In terms of the instructions governing 'Issue of CP', its renewal is not allowed. However, in the case of need, permission of RBl for fresh issue may be sought.

4) Minimum Investment Requirement :

CP can be issued in denominations of Rs. 5 lacs or multiples thereof. Amount invested by a single investor should not be less than 5 lacs (face value).

Advantages of Commercial Paper :

Issue of commercial paper is a good option for raising short-term finance, due to following advantages :

1) Alternate Source of Finance :

It is an alternate source of short-term finance, especially during the tight period of credit policy adopted by banks, due to hawkish monetary policy of the Central Bank.

2) Cheaper and Convenient :

It is comparatively cheaper and convenient source of finance than the bank finance. Generally, yield on the commercial paper is lower than that of the base rates of commercial banks.

3) Safe Investment :

From the investor's viewpoint, it is an opportunity for safe investment of funds lying idle for a short period.

Disadvantages of Commercial Paper :

Despite the positive features of commercial paper, this route of raising short-term finance suffers from following disadvantages :

1) Impersonal Method :

It is an impersonal method of financing, as the guidelines governing issue of CP are not flexible. In case an issuer of CP is not in a position to redeem the instrument due to cropping up of some unforeseen circumstances, there is no provision of getting the maturity period of the CP extended.

2) Suitable for Highest Rating Company :

Only financially healthy companies with highest rating can raise short-term funds through the issue of CP. A company suffering from a liquidity crunch of temporary nature may not be able to get permission to issue CP, if it is unrated or poorly rated.

3) Restriction on Different Purchaser :

The amount of funds, which the purchaser of a CP is entitled to take as loan against the instrument, is restricted to the amount of excess liquidity of the different purchasers of commercial paper.

4) No Premature Repayment :

Commercial Paper is redeemable only on the date of maturity. There is no provision for premature repayment or repayment before the due date (minimum 7 days and maximum up to 1 year from the date of issue). If a company (the issuer), does not need the funds sometimes after the issue but before the maturity, it does not have the option to repay the investors until maturity and will be compelled to incur interest costs.

4) Certificate of Deposit (CD) :

Certificate of Deposit (CD) is a document/financial instrument which certifies that there is a bank deposit to support it. CD is also a tradable money market instrument. Thus, basically CD is nothing but a tradable bank deposit and transferable from one holder to another, till the maturity of the underlying bank deposit. Interest is paid in the normal course to the holder of the instrument. However, the market value of the CD depends on the difference between the rate of interest on that bank deposit (which is fixed) and the general rate of interest prevailing in the market (which is variable). CDs are issued by banks with a view to encouraging the short-term deposit mobilisation.

Advantages of Certificate of Deposit :

The certificate of deposit, as a short-term investment instrument, has certain advantages in its favour, which are as follows :

1) Better Return :

Rate of Interest on CD is better as compared to the one available on savings bank account.

2) Safe Return :

Certificate of Deposit provides safe investment opportunity with substantial returns, especially for the investors who are not wiling to enter the stock market but would like to earn as much as these investors. Although the returns from CD are not comparable with the one from stock market, investment in CD is much safe and devoid of any risk element.

3) Good Long-Term Effect :

The long-term effect of Certificate of Deposit is remarkable, as it is a good combination of both the objectives of an investment, viz., safety and return.

Disadvantages of Certificate of Deposit :

Despite the advantages of Certificate of Deposit mentioned above, they do have following disadvantages :

1) Less Return :

In relation to other investment opportunities available in the market, the return on certificate of deposit is less.

2) Long Maturity Period :

The money invested in certificate of deposit is locked up till the maturity period of the underlying bank deposit.

3) Penalty :

Premature exit from the certificate of deposit holding involves imposition of heavy penalties.

4) Need Patience :

Since the maturity period of certificate of deposit is comparatively long, a lot of patience is required by investors to have better returns.

5) Letter of Credit (LC) :

A Letter of Credit (LC) is a facility extended by a buyer's bank, under which the latter (bank) helps the former (customer) in obtaining credit from the suppliers. It is a form of a guarantee given by the bank, on behalf of its customer, for certain purchases made by it. In case of customer's failure to make the timely payment, it becomes the responsibility of letter of credit opening bank to honour the commitment of its customer.

For example, a bank opens a LC in favour of its customer 'A' for some purchases, 'A plans to make from the supplier 'B'. In the event of failure on the part of 'A' to make payment to B' in terms of the agreement of the credit period offered by B', it becomes the bank's responsibility to make the payment on behalf of 'A' for the purchases covered under the LC arrangement. In such cases, the supplier draws a lot of comfort regarding payment of its dues and as such there is no problem to extend credit to a buyer in favour of whom a bank opens a LC.

Advantages of Letter of Credit :

Advantages of letter of credit are as follows :

- Letter of credit is a form of bank guarantee and as such does not appear in the balance sheet of the buyer (it is an off-balance sheet transaction). The buyer's borrowing capacity, thus, remains unharmed.

- Payment of purchases under letter of credit arrangement needs to be made only after the documents are received.

- Letter of credit being a form of bank guarantee, the seller remains protected against default by the buyer.

- The letter of credit deals only with documents. The seller gets the payment promptly, if the documents are in order.

- If the documents are incomplete, the buyer is empowered to deny the payment. This empowerment gives rise to negotiation between buyers and sellers.

- The buyer can also authorise the letter of credit opening bank to pay an advance to the seller.

Disadvantages of Letter of Credit :

Major disadvantages of letter of credit are as follows :

- Bank's requirement of Cash Margin involve immediate cash outflow for the buyer.

- Bank charges for the services provided by it for opening of letter of credit, is a cost to the buyer.

- A buyer can deny payment on insubstantial basis, such as the mismatch in the spelling of the buyer's name in the invoice and other documents.

- In case the buyer fails to honour the documents and the letter of credit opening bank is also not stable, then there may be changes of default in payment even by the bank.

6) Installment Credit :

Installment credit is a financial arrangement, under which the payment of goods and services are made over a period of time in regular installments (consisting of payment of partial principal and interest accrued thereon). Installment credit is popular between the buyers and sellers of consumer goods (T.V., Refrigerator, A.C., Washing Machine, etc.), cars, houses, etc. For a better understanding of the concept, an example of car loan may be taken. If a buyer 'A' borrows Rs.3,00,000 to buy a new car, the lender may like to set his payments at Rs.6,000 per month for 60 months. Over the next 60 months, 'A' would make payments of Rs.3,60,000. The Rs.3,00,000 amount is the principal and Rs.60,000 represents the interest accrued on the borrowed amount of Rs.3,00,000.

Advantages of Installment Credit :

The installment credit is a convenient mode of finance suitable for both the buyer as well as the seller. The advantages under this arrangement are as follows :

1) Immediate Possession' of Assets :

Assets is immediately delivered after the completion of certain formalities upon the down-payment (payment of initial installment).

2) Convenient Payment for Asset and Equipments:

Costly gadgets, equipments, and other assets, which cannot be purchased outright due to lack of funds, can be conveniently bought through installment credit.

3) Saving of One Time Investment :

If the cost of asset to be purchased happens to be very high and the option of outright purchase thereof is used, there would be outflow of substantial amount of funds. Installment credit results in savings of one time investment.

4) Supports Expansion and Modernisation of Business and Office :

If the necessary furniture, equipments, gadgets and machineries, etc. are available on installment credit, organisations can think of buying them on 'Installment Credit' Thus, Installment Credit facilitates expansion and modernisation of business and office.

Disadvantages of Installment Credit :

"Installment Credit' suffers from following disadvantages :

1) Committed Expenditure :

Payment of installments of the assets purchased on installments is a mandatory expenditure, which needs to be met irrespective of the fact whether the company earned profit or incurred loss in the business.

2) Obligation to Pay Interest :

Under the 'Installment Credit' system, the rate of interest charged by the seller is on a higher side and payment thereof is obligatory.

3) Additional Burden in Case of Default :

Sellers generally incorporate stringent clauses in the form of penalty or additional interest, in case of failure on the part of a buyer in making the installment payment. They do not hesitate in call upon those clauses in he case of default in payment of installment.

4) Cash does not Flow :

'Installment Credit' facilitates the purchase of an asset or equipment by allowing deferment of payment. As a result, the seller is deprived of cash, which otherwise would have been available to the seller for various uses.

7) Bank Finance :

Bank borrowing is one of the important sources of finance for the companies in the need of funds, especially working capital requirements. Bank borrowing, as a source of short-term finance, ranks just next to Trade Finance, which is the most popular mode of short-term finance in India. The amount approved by a bank for a company's working capital needs is termed as Credit Limit'. The maximum amount of credit, a company may obtain from the entire banking system in India, is referred to as Maximum Permissible Bank Finance (MPBF). For seasonal industries, banks are expected to prescribe separate credit limits for 'Peak Season' and 'Non-peak Season' indicating the period during which such limits would be utilised by the borrower.

Generally, banks do not extend 100% of the credit limit sanctioned by them. An amount known as 'Margin Money' is deducted from the Credit Limit. The concept of 'Margin Money' is based on the principle of conservatism and is basically in place to ensure security. If the 'Margin Money' requirement is 20%, the lending bank would extend borrowing facilities only up to 80% of the value of the asset. This implies that the security of bank's lending should be maintained even if the asset's value falls by 20%.

Forms of Bank Finance :

Outsourced Finance, Once the credit limits of a company are sanctioned by the banker, funds can be utilised, within the limits of 'Maximum Permissible Bank Finance' in the following manners.

1) Term Loans :

Term loans are generally granted by banks for a fixed period for the acquisition of fixed assets. The interest rate charged on term loans is linked to the base rate of the bank. The interest rate is also revised, as and when the base rate of the bank is revised. The repayment schedule of the term loan is fixed at the time of the sanction by the bank. The repayment of a loan can be done through "Equated Monthly Installments" (EMI), which includes repayment of the partial principal amount and interest accrued thereon. The borrower has an option to repay the loan through "Equated Principal Installments" (EPI) also. The primary security made available for a term loan is the asset (s) created.out of the loan. On the other hand, the collateral securities may have a charge on one or more of the following :

i) Assets not created out of the loan.ii) Lien created on the deposits of the owners of the borrowing company or other third parties.iii) Fixed deposits or any other financial instruments like Indira Vikas Patra, KisanVikas Patra, NSCs, LIC Policies, etc. deposited with the bank.

2) Cash Credit :

A Cash Credit facility is working capital finance extended by a commercial bank to its borrowers against the primary security of current assets, like inventory, sundry debtors, etc. The primary security may either be hypothecated in favour of the bank or it may be pledged' with the bank. Cash Credit is availed by the manufacturing units for the purchase of raw materials and by trading units for buying finished goods. Cash Credit account is a running account, from which money is withdrawn to purchase raw materials or finished goods and sales proceeds are deposited in the Cash Credit account to be again withdrawn for the purchases. This cycle goes on and on. However, the withdrawal of money is restricted to the amount of cash credit limit sanctioned to a particular borrower. Under the cash credit (hypothecation) account, the physical possession of the raw materials or goods remains with the borrower who has to use them for production of finished goods and their selling in the market.

3) Overdrafts :

Under this arrangement, banks allow their esteemed customers to withdraw beyond the balance available in their account. This is extremely useful in cases where a company is suffering from short-term cash flow problem and does not require large amount of funds on a long-term basis. A borrower in need of such kind of facility may approach his banker and negotiate for an overdraft facility. The bank after satisfying itself with regard to the borrower's history (of operations in the account and credit-worthiness) may sanction an overdraft limit. Like cash credit limit, overdraft limit is also a revolving facility i.e., having any fixed period for repayment), which involves overdrawing in the account and its regularisation by depositing money, and again overdrawing and regularising the account.

The advantages of overdraft is the facility of drawing extended by a bank ensures availability of cash (within the limit) on tap and the borrower is relieved of day-to-day worry of managing funds for its business operations. In essence, the cash management functions of a borrower are taken over by its banker. Another advantage of availing overdraft facility from a bank is that the interest calculation, to be charged from the borrower, is done on a daily basis. Therefore, the interest burden on a borrower is only limited to the actual time and amount of borrowing, i.e., the interest accrued on the amount of borrowing and the time period for which the borrower has availed it.

4) Bills Discounting :

Discounting the 'Bill of Exchange' is one of the major activities of some of the banks. 'Bill Discounting' is a short-term money market instrument, which is negotiable and self-liquidating in nature.

The process of bill discounting involves following steps:

i) Drawing of bill by a bank borrower on its customer by subtracting commission and its acceptance by the latter.ii) Presenting the bill by the borrower to its banker for discounting.iii) Discounting of the bill and upfront payment to the borrower by the bank.iv) Presentation of the bill by the bank to its borrower's customer on due date for collection of the entire amount.

In case of delay in payment by the borrower's customer, the borrower or his customer is liable to pay interest as per the terms of transaction agreed upon by the bank and its borrower.