What is Financial Information System ?

Financial Information System (FIS) is a CBIS system from which the people or a group both internal and external to the organisation can get information regarding the various financial matters of the firm.

Information is generally presented in the form of advice of expert systems, results of mathematical simulation, special reports, electronic communications and periodic reports.

Financial information generated by a financial MIS are not only used by the executives but also used by people who make daily decisions based on the financial matters. The reports of the transactions can be streamlined with the help of financial MIS.

The organisation's financial needs are satisfied by the financial management. It is also possible to meet the statutory compliance by submitting various returns and reports to the Tax Authorities and Government, and by the declaration of financial results.

Financial management helps the organisation in meeting their goals using various tools. Some of the tools are as follows:

- Break even analysis

- Cost Analysis

- Cash-flow Projections

- Ratio Analysis Capital Budgeting

- Management Accounting

- Financial Modelling, and so on

Functions of Financial Information System

The following functions are performed by most of the financial MISS:

1) Operational and financial information obtained from various sources such as Internet are integrated into a single system.

2) Both the financial and non-financial users can access data via corporate intranet. The corporate web pages that contain the financial information and data can be accessed easily.

3) The analysis turnaround time can be easily shortened by making the financial data immediately available.

4) Financial data can be analysed along various dimensions such as customer, product, time, geography, and plant.

5) Analyse the current financial as well as the historical operations.

6) The use of funds over time are monitored & controlled by financial MIS.

Components of Financial Information System

The components of a FIS typically include:

- Data Input: Collection and entry of financial data from various sources such as transactions, invoices, and payroll records.

- Data Processing: Organization, classification, and analysis of financial data to generate meaningful information.

- Database Management System (DBMS): Software used to store, retrieve, and manage financial data efficiently.

- Financial Reporting: Preparation and distribution of financial statements, including balance sheets, income statements, and cash flow statements.

- Budgeting and Planning Tools: Software for creating and managing budgets, forecasts, and financial plans.

- Internal Controls: Policies, procedures, and security measures to ensure the accuracy, reliability, and integrity of financial data.

- Audit Trail: Documentation of all financial transactions, changes, and activities for accountability and compliance purposes.

- Decision Support Tools: Software and tools to assist management in financial analysis, scenario planning, and decision-making.

- User Interface: Interface for users to interact with the financial information system, including dashboards, reports, and query tools.

- Integration with other Systems: Ability to exchange data with other systems such as ERP, CRM, and HRM for seamless information flow across the organization.

Model of Financial Information System

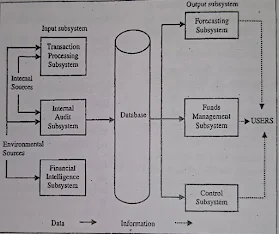

Figure shows the model of a FIS:

The different components of the financial information system are as follows:

1) Input Sub-systems:

This sub-system consists of the following:

i) Transaction Processing System (TPS):

This sub-system provides input data to system in similar format as MkIS uses.

ii) Internal Audit Sub-system:

In order to ensure that financial data of the firm is processed in the right manner, the internal auditors of the firm carry out internal audit by analyzing the conceptual systems of the firm.

iii) Financial Intelligence Sub-system:

The environmental data related to financial issues is gathered by using this sub-system.

2) Database:

The database supplies data to be used to the output sub-systems. The database gets the data from the input sub-systems (TPS, internal audit sub-system and financial intelligence sub- system).

3) Output Sub-systems:

Financial information system consists of the following output sub- systems:

i) Forecasting Sub-system:

This sub-system plans how long the firm's activity will perform in the economic environment

ii) Fund Management Sub-system:

The main aim of the fund management sub-system is to keep the fund positive and balanced by managing the flow of money.

iii) Control Sub-system:

The managers can use various resources in an effective manner with the help of the control sub-systems.

Types of Financial Information System

Here are some common types of FIS:

1) Transaction Processing Systems (TPS): These systems record and process routine transactions such as sales, purchases, payments, and receipts.

2) Accounting Information Systems (AIS): AIS focuses on financial transactions and generating financial statements. It includes modules for general ledger, accounts payable, accounts receivable, and payroll.

3) Management Information Systems (MIS): MIS provides managers with reports and analysis tools to support decision-making. It includes financial planning, budgeting, forecasting, and variance analysis.

4) Enterprise Resource Planning (ERP): ERP integrates various business functions, including finance, accounting, human resources, and supply chain management, into a single system. It enables data sharing and streamlines processes across departments.

5) Decision Support Systems (DSS): DSS helps managers make non-routine decisions by providing access to relevant data, models, and analytical tools. It includes tools for financial modeling, scenario analysis, and what-if analysis.

6) Executive Information Systems (EIS): EIS provides top-level executives with summarized financial data and key performance indicators (KPIs) through dashboards and reports. It supports strategic decision-making and monitoring organizational performance.

7) Financial Reporting Systems: These systems focus specifically on generating financial reports required for external stakeholders, such as investors, regulators, and creditors. They ensure compliance with accounting standards and regulations.

8) Budgeting and Forecasting Systems: These systems assist in creating and managing budgets, forecasts, and financial plans. They enable organizations to allocate resources effectively and monitor performance against targets.

Inputs of FIS

Financial management accepts various forms and documents as inputs. Taking into consideration the needs of the various organisations, the forms and documents are designed in a specific format. Following are the forms of input that financial management uses:

- Payments

- Receipts

- Data from stock exchange

Applications of Financial Information System

The primary application of financial management is the financial accounting system which handles the financial transactions of the organisation and produces the financial results.

1) Accounting:

The financial accounting management component of financial management controls various operations associated with accounting. The various direct and indirect financial transactions that affect organisation are handled by this system. Given below are some of the aspects:

- Sales

- Purchase

- Capital purchase

- Inventory

- Fixed deposits

- Shareholder's funds

- Income tax

- Salary/wages

- Budgets

- Fixed assets

2) Query:

The query system component of financial management lists the transactions involved in producing the balance by means of debit or credit balance of the accounts. The following queries are involved in query system:

- Main account

- Subsidiary account

- Location of Factory, Branch

- Documents, such as bills, credit notes, receipt, etc.

3) Decision Analysis:

Financial managers have to take various decisions such as selecting investment alternatives, analyzing debtors and creditors, capital budgeting, and borrowing short- term working capital by analyzing financial status of the company. To support such decisions of financial management, the following applications are available:

- Cash-flow analysis

- Debtors analysis and aging

- Creditors analysis and aging

- Sources and uses of funds

- Budget analysis

- Capital budgeting and ranking of investment alternatives

4) Control:

The cost associated with running the business increases if the business does not progress according to the plans. The control applications take care of such situations by focusing on the expectations that arises as a result of the business operations. Following are some of the prime expectations:

- Accounts receivable, outstanding beyond the acceptable norms

- Analysis of non-moving accounts and legal actions

- Advances to creditors and non-realization of obligations

- Shortage of funds in excess of planning and rescheduling of activities and priorities

- Cost over-runs beyond the norm and action on alternatives

The control applications come out with revised business terms and conditions by taking decisions that are based on the expectations mentioned above. They are as follows:

- Selecting optional source of financing

- Revising specific activities to reduce the expenses

- Relocating resources

- Revising schedules, plans, and priorities

Reports of Financial Information System

How information will be managed in the company is greatly affected by the information received by the financial management. The financial data is basic in nature and very reliable because it can be checked, audited and validated carefully with the help of computer system.

The statutory compliance and operations update obtained from financial management is primarily considered by the top management. The major categories of reports are as follows:

1) Statutory Compliance:

- Sales tax registers

- Tax returns

- Excise registers

- Periodical public announcement of financial results

- Announcement of annual results to the board, shareholders and public

2) Knowledge Update:

- Trial balance, balance sheet, and profit and loss account on monthly basis

- Valuation of stock

- Receivable accounts and aging

- Payable accounts and aging

- Expenses on major accounts

- Availability of cash

- Overall business achievement in main business areas.

3) Operations Update:

- Statutory returns and reports filling

- Statutory payments including advance tax, sales tax, excise duty, etc.

- Reports on finished goods and dispatches

- Report on payments to the sellers

- Report on material collected

4) Decision Analysis:

- Break even analysis for price and cost decision

- Return on Investment (ROI) analysis for selected investment

- Trend analysis on price of chosen commodities,

- Analysis of current liabilities,

- Analysis of current and fixed assets

- Analysis of overdue receivables

5) Action Update:

Decision analysis focuses on those areas where actions are to be taken, based on the decisions made. Generally these actions are performed in exceptional cases. The reports of actions implemented and their effects on the business consists of:

- Overdue receivables due to which legal actions can be taken and business association can be terminated

- Legal actions, terms revision and termination of business association when goods and services are not supplied even though payment has been made

- Payments to creditors with penalties

- Poor usage of fixed assets

Advantages of Financial Information System

- Streamlines financial processes, reducing manual errors and improving efficiency.

- Provides real-time access to financial data for timely decision-making.

- Enhances financial reporting accuracy and compliance with regulatory requirements.

- Facilitates better financial analysis and forecasting through comprehensive data integration.

- Enables easier tracking of financial performance metrics and key performance indicators (KPIs).

Disadvantages of Financial Information System

- Initial setup costs and implementation challenges can be substantial.

- Requires ongoing maintenance and updates to ensure data integrity and system reliability.

- Security risks associated with storing sensitive financial information in digital format.

- Dependency on technology may lead to disruptions in case of system failures or technical issues.

- Potential for resistance to change among staff members accustomed to traditional financial processes.