Checks are still extensively used nowadays despite being less popular than they previously were in the digital age. Every adult should be able to write checks, and the instructions in this article will show you how to do it. Regular check writers find that the procedure almost becomes automatic. It can be tricky and confusing, though, if you haven't written many checks. You'll work your way through a check in this post from top to bottom, which should prevent you from skipping any tasks.

What is Check or Cheque ?

A check is a written, signed, and dated financial instrument that directs a bank or other financial institution to pay a specific amount of money to the person or organization named on the check. Checks are typically used to make payments for goods or services or to transfer money from one account to another.

When you write a check, you include the name of the recipient, the payment amount in numerical and written form, the date, and your signature. The recipient then deposits or cashes the check, and the funds are transferred from your account to the recipient's account.

Checks are one of the oldest and most widely used forms of payment in the world, and they continue to be an important tool for managing personal finances and conducting business transactions. While electronic forms of payment like credit cards and digital wallets have become increasingly popular in recent years, checks remain a common way to pay bills, make purchases, and transfer funds.

Before Writing the Check

Before writing a check, there are a few things you should do to ensure that you have all of the necessary information and that you're making a payment that you can afford. Here are some steps to follow :

- Make sure your checking account is always stocked with enough money. If you don't, your payments could "bounce" and result in complications, such as high fees and possible legal troubles.

- Make sure that you have the correct name and address of the recipient. If you're not sure, double-check with the recipient before writing the check.

- Determine the purpose of the payment and whether you need to include any additional information or documentation with the check.

- Review your checkbook or online banking records to make sure that you haven't already made a payment to the recipient that hasn't cleared yet.

- If you're sending the check through the mail, make sure that you have the correct mailing address and that you've included any necessary paperwork or documents.

By taking these steps before writing a check, you can help to ensure that the payment is accurate, secure, and processed without any issues.

How to Write a Check ?

Filling out a check (cheque) is a straightforward process. Follow these steps to fill out a check correctly :

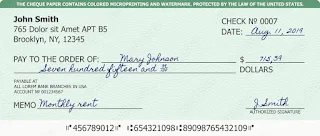

1) Current date :

Write the date in the top right corner of the check. Use the full date, including the month, day, and year.

2) Payee or Recipient's name :

Write the name of the recipient on the "pay to the order of" line. Make sure to spell their name correctly and write legibly.

3) Amount in numeric form :

Write the payment amount in numerical form in the box provided, starting from the left-hand side. Make sure to include any cents, even if it's zero.

4) Amount in word form :

Write the payment amount in words on the line below the recipient's name. Be sure to write it legibly and use the appropriate fraction for any cents. For example, you might write "one hundred fifty and 45/100" if you were paying $150.45. Make sure to put the cents amount over 100 when writing a check with pennies. Including "and 00/100" nonetheless if the quantity is a round figure for further clarity. For a bank to execute a check, the dollar amount must be written down since it verifies the correct payment amount.

5) Signature :

Sign the check in the bottom right-hand corner. Make sure to sign it the same way you've signed any other official documents.

6) Memo :

Write any necessary notes or memos in the memo section of the check, which is usually located in the bottom left-hand corner.

Make a record of the check in your check register or personal finance software to keep track of your spending. Once you've completed all of these steps, your check is ready to be deposited or cashed by the recipient.

After You Write the Check

After you've filled out the check, there are a few things you should do :

- Review the check to make sure that all of the information is correct, including the amount, recipient, and date.

- Record the transaction in your check register or personal finance software, so you can keep track of your spending.

- Tear out the check from your checkbook along the perforated edge.

- If you're mailing the check, place it in an envelope and address it to the recipient. You can also include any necessary paperwork or documents.

- If you're hand-delivering the check, make sure to hand it directly to the recipient and get a receipt if necessary.

- Keep a copy of the check or make note of the check number, amount, and recipient in case you need to refer to it later.

Remember that once you've written a check, the money is no longer available in your account until the check is deposited or cashed. So, make sure you have sufficient funds in your account to cover the check amount.

How to Write a Check with Cents ?

Writing a check with cents involves writing out the dollar amount first, followed by the word "and," and then writing out the cents as a fraction of a dollar. Here's an example :

- Start by writing the dollar amount in words, including the word "dollars" at the end. For example: "Twenty dollars."

- Next, write the word "and" followed by the number of cents in numerals. For example: "and 50/100" or "and 75/100."

- Finally, write the total amount in numerals in the box provided on the right-hand side of the check.

Here's an example of a completed check with Cents :

Pay to the Order of: John Smith

Twenty dollars and 50/100

$20.50

Date: [Insert the date]

Signature: [Sign your name]

Tips for Writing a Check

Here are some tips to keep in mind when writing a check :

- Always use a pen with black or blue ink. Avoid using pencils or other colors of ink, as they can be difficult to read or may be erased.

- Write legibly and clearly. Make sure that the recipient's name, payment amount in words, and numerical form are all easy to read and understand.

- Use the full date, including the month, day, and year. This will help to avoid confusion and ensure that the check is processed correctly.

- Make sure that the payment amount in words matches the numerical amount. If there is a discrepancy, the bank may not honor the check.

- Double-check the spelling of the recipient's name, as well as the accuracy of their address, if applicable.

- Write any necessary notes or memos in the memo section of the check, such as the purpose of the payment or an account number.

- Sign the check in the bottom right-hand corner using the same signature that you use on other official documents.

- Keep your checkbook and any blank checks in a secure place to prevent them from being lost or stolen.

By these tips, you can ensure that your checks are accurate, secure, and processed without any issues.

How to Balance a Checkbook ?

Balancing a checkbook involves reconciling your records of transactions with your bank's records to ensure that your account is accurate and up-to-date. Here are the steps to balance a checkbook :

- Keep track of all deposits and withdrawals from your account in a checkbook register. This can be a physical register or a digital tool like a spreadsheet or personal finance app.

- Compare your transactions in your checkbook register with your monthly bank statement to identify any discrepancies.

- Check off all transactions that match your bank statement. If there are any transactions that you have recorded but that are not reflected in your bank statement, make sure that they have not been accidentally omitted from your statement.

- Add up all of the deposits and withdrawals that have not been checked off to identify any discrepancies or errors. This will help you to identify any mistakes you may have made when recording transactions in your checkbook register.

- Adjust your checkbook register to reflect any discrepancies or errors, and make sure that your balance matches your bank statement balance.

- Keep your checkbook register up-to-date by recording all of your transactions as they occur.

Balancing your checkbook regularly is important to ensure that you have an accurate record of your account and to prevent overdrafts or other issues that can arise from incorrect records. By following these steps, you can balance your checkbook with ease and confidence.

Frequently Asked Questions

Can you write a check for yourself?

Yes, You may issue a check to yourself legally. A check made payable to yourself may be deposited at an ATM, a bank branch, or through a mobile banking app. Put your name in the "Pay to the Order of" section of the check and follow the same procedure as described previously. As soon as you deposit the check, you must sign the back.

What is a check bouncing?

A check that bounces indicates that it was written while there was no money in the account.

Who pays for a bounced check?

Fees for a returned check are levied to the check's author.

When should I sign the check?

You should not sign a check until you have written the amount in both written and numeric form and completed the "Pay to the Order of" section. By signing a blank check, you expose your bank account in the event that you misplace it or it is stolen.

How to write a check for blank checks?

You sign it after writing the name, date, and amount (the legal figure) in both numerals and longhand.

What happens if there is no money in your account, when you write a check?

Insufficient funds will cause a cheque to be returned if you write one without any funds in your account. If you intentionally or accidentally write a check out to someone who doesn't have money in their account, they won't be paid. You will incur costs for a returned check and your bank account will go into overdraft since you will have a negative balance in your checking account.