What are the Tools & Techniques of Capital Expenditure Control ?

The 4 tools & techniques of capital expenditure control are describes as follows :

- Performance Index

- Technical Performance Measurement (TPM)

- Post Completion Audit

- Earned Value Method

Performance Index

Often it is necessary to present information from several related areas simultaneously. This is done to provide a statistical measure of how performance changes over time. The performance index is a management tool that allows multiple sets of information to be compiled into an overall measure. The two Performance Indexes in the project cost management. These indexes are :

Schedule Performance Index (SPI)

The Schedule Performance Index is the ratio of total original authorized duration versus total final project duration. The ability to accurately forecast schedule helps meet time-to-market windows. SPI Standard Deviation is an even better metric that shows the accuracy of schedule estimating. The Schedule Performance Index tells us about the efficiency of time utilized on the project. It is a measure of progress achieved compared to the planned progress.

Schedule Performance Index = (Earned Value)/(Planned Value)

SPI = EV/PV

The Schedule Performance Index informs us how efficiently we are actually progressing compared to the planned progress.

Note :

- If Schedule Performance Index (SPI) is greater than one, this means more work has been completed than the planned work.

- If SPI is less than one, this means less work is completed than the planned work.

- If SPI is equal to one, this means the work completed is equal to the planned work.

Cost Performance Index (CPI)

The Cost Performance Index is a measure of cost efficiency. It's determined by dividing the value of the work actually performed (the earned value) by the actual costs that it took to accomplish the earned value. The ability to accurately forecast cost performance allows organizations to confidently allocate capital, reducing financial risk, possibly reducing the cost of capital. CPI Standard Deviation is an even better metric, one that shows the accuracy of budget estimating. The Cost Performance Index tells us about the efficiency of the cost utilized on the project. It is the measure of the value of the work completed compared to the actual cost spent on the project.

Cost Performance Index = (Earned Value)/(Actual Cost)

CPI = EV/AC

The Cost Performance Index informs us how much we are earning for each dollar spent on the project.

Note :

- If Cost Performance Index (CPI) is less than one, this means we are earning less than the spending.

- If CPI is greater than one, this means we are earning more than the spending.

- If CPI is equal to one, this means earning and spending is equal.

Technical Performance Measurement (TPM)

A Technical Performance Measure (TPM) is a key indicator of progress, parameter or a metric that can be used to monitor the progress or performance of selected requirements. A technical performance measure is monitored to ensure that it remains within tolerances as an indication of the progress of the design. A technical performance measure is one of the most commonly used systems engineering tools. Technical performance measures are identified at a very early stage in the systems engineering process (during Conceptual Design) and their progress is continually monitored throughout the acquisition phase as a major risk-mitigation measure.

Technical Performance Measurement (TPM) is an analysis and control technique that is used to :

- Project the probable performance of a selected technical parameter over a period of time.

- Record the actual performance observed of the selected parameter.

- Through comparison of actual versus projected performance, assist the manages in decision-making.

A well thought out programme of technical performance measures provides an early warning of technical problems and supports assessments of the extent to which operational requirements will be met, as well as assessments of the impacts of proposed changes in system performance.

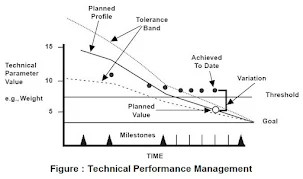

TIMs generally take the form of both graphic displays and narrative explanations. The graphic, an example of which is shown in figure, shows the projected behavior of the selected parameter as a function of time, and further shows actual observations, so that deviations from the planned profile can be assessed.

The narrative portion of the report should explain the graphic, addressing the reasons for deviations from the planned profile, assessing the seriousness of those deviations, explaining actions underway to correct the situation if required, and projecting future performance, given the current situation. Parameters to be tracked are typically based on the combined needs of the government and the contractor. The government programme office will need a set of TPMs which provide visibility into the technical performance of key elements of the WBS, especially those which are cost drivers on the programme, lie on the critical path, or which represent high risk items.

The Technical Performance Measurement (TPM) selected for delivery to the government are expected to be traceable to the needs of the operational user. The contractor will generally track more items than are reported to the government, as the contractor needs information at a more detailed level than does the government programme office. TPM reporting to the government is a contractual issue, and those TPMs on which the government receives reports are defined as contract deliverables in the contract data requirements list. Which parameters are selected for reporting depends on a number of issues, among which are resources to purchase TPMs, the availability of people to review and follow the items, the complexity of the system involved, the phase of development, and the contractor's past experience with similar systems.

Technical performance measurement measure attributes of a system clement to determine how well a system or system element is satisfying or expected to satisfy a technical requirement or goal. These measures are used to assess design progress, compliance to performance requirements, or technical risks. TPMs are derived from or provide insight for the MOPs focusing on the critical technical parameters of specific architectural elements of the system as it is designed and implemented. Selection of TPMs should be limited to critical technical thresholds or parameters that, if not met, put the project at cost, schedule, or performance risk. The TPMs are not a full listing of the requirements of the system or system element.

TPMs include the projected performance, such as performance profile with tolerance bands of acceptable variance. Performance of the system or system element is tracked through the life cycle and compared to the projected and required values. Early in the life-cycle the performance values may be estimated, based on simulation and modelling. As the life cycle proceeds, actual data replaces estimates and adds to the fidelity of the information. This measurement of the design solution as it evolves allows action to be taken early in the process, rather than wait until system testing to address performance problems. Technical performance measurement enable an assessment of the product design by estimating the values of key performance parameters of the design through engineering analyses and tests. Analysis of these measures provides risk indicators for key performance parameters.

TPMs can include, but are not limited to, range, accuracy, weight, size, power output, timing (throughput, response time, processing time, etc.), security requirements, and the product quality characteristics related to critical operational requirements (reliability figure of merit, failure rate, mean time to failure/repair/restore, availability, fault tolerance, etc.).

Characteristics of TPM

The characteristics of Technical Performance Measurement are as follows :

- It should be important and relevant.

- TPM are relatively easy to measure.

- Performance should be expected to improve with time.

- If the measure crosses its threshold, corrective action should be known.

- The measured parameter should be controllable.

- Management should be able to trade-off cost, schedule and performance.

- TPM should be documented.

- It should be tailored for the project.

Uses of TPM

Technical Performance Measurement are used to :

- Forecast the values to be achieved for key performance parameters.

- Identify differences between actual versus planned performance.

- Assess and predict progress towards achieving the key performance parameters.

- Determine the impact of differences between actual and planned performance on system effectiveness.

- Provide early identification of risks and detection or prediction of problems requiring management attention (e.g., where negative margins exist).

- Determine where opportunities exist to make design trades to reduce overall risk (e.g.. where positive margins exist).

- Early determination of where critical requirement flow down to the next level of design is inadequate.

- Support assessment of system element design alternatives or impacts of proposed change alternatives.

- Monitors incorporation and results of new critical technologies.

Requirement Criteria for TPM Creation

The requirement criteria for technical performance measurement creation are as follows :

1) High priority requirements that have an impact on :

- Mission accomplishment,

- Customer satisfaction,

- Cost,

- System usefulness.

2) High risk requirements or those where the desired performance is not currently being met :

- The system uses new technology.

- New constraints have been added.

- The performance goal has been increased.

- But the performance is expected to improve with time.

3) Requirements where performance can be controlled.

4) Requirements where the programme manager is able to re-balance cost, schedule and performance.

5) TPMs should meet all of these characteristics.

6) Less than 1% of requirements should have TPMs.

Collecting, Reporting and Displaying TPM Data

The collection, reporting and displaying technical performance measurement data are as follows :

- Systems engineering manager is responsible for collecting analyzing, reporting and responding to TPM data.

- Technical performance measurement should be presented to the person who can do something about it. Often this is the chief engineer.

- Programme manager has oversight.

- Measures analysis group might use them for process improvement suggestions.

- TPM measures can be displayed with graphs, charts, diagrams, figures or frames. For example, statistical process control charts, run charts, flow charts, histograms, pareto diagrams, scatter diagrams, check sheets, PERT charts, Gantt charts, line graphs, process capability charts and pie charts.

Post Completion Audits (PCA)

Post-project evaluation is also known as post-audit or post-completion audit. It is an evaluation of the project after its completion. At the time of project appraisal, estimates are made for project cost and for project completion time. After the project is completed, project audit is carried-out to assess the actual project cost and the actual time taken for project completion. Thus, while project appraisal is an estimate for the "future", post project evaluation is an assessment of the 'past'. In respect of public projects, apart from studying the variations in project cost and project completion time, post-project evaluation also makes an assessment of the actual social cost-benefit factors and the extent up to which the project's objectives are achieved.

Post completion audit aims to evaluate the efficiency and effectiveness of the capital budgeting decision that the management has implemented. It compares between the planned and the actual outcome, costs and the use of resources, results and benefits. It contains all assumptions that were made during the decision-making period. It is one of the ongoing continuous processes through which the organization learns and improves.

According to Murdick and Deming :

"It is a check on whether the planned benefits are being realized after the project has been operating for some period of time".

According to Donald Istvan :

"It is a study made to ascertain the actual performance results, to compare those results with those predicted in the proposal, and to take action regarding any differences between the two".

According to Kohler :

"It is an audit at some point after the occurrence of a transaction or a group of transactions".

Objectives of PCA

Experience is the greatest teacher. The knowledge gained during the process of project implementation is of great value to all concerned. The project owner and the project management team learn a lot during the course of project implementation and they become a store house of knowledge which they can share with others or use them in their future ventures.

By carrying-out post project evaluation, the financial institution that has funded a project can identify the pitfalls, if any, in its project appraisal and the control mechanism that should have been followed for effective project monitoring. For example, the financial institution might have estimated the project implementation time for a particular project during its appraisal, based on which it would have provided for 'interest during implementation as a a component of the project cost. Further, the financial institution would have fixed the commencement of loan repayment schedule, keeping in view the estimated project implementation time. If the actual project implementation period exceeds the estimate made, the time-overrun would result in cost-overrun of the project.

The loan repayment schedule also-might need replacement in view of delayed project implementation. The financial institution can learn from reality, the factors to be considered for correctly assessing the project implementation time. Post-project evaluation by financial institutions will also throw light on the following aspects :

- The adequacy of 'contingency' provision made in the project cost estimate to take care of unforeseen expenditures.

- The normal project implementation time for different projects.

- The comparative project cost for similar projects.

A contractor who has executed a project and completed the project in time might have incurred additional expenditures than what was originally envisaged by him. This will enlighten him to be cautious while quoting his bid for subsequent projects. It can also make use of his experience to guard against uncertainties in future.

Based on the points discussed above, the objectives of post-audit can be summed-up as under :

- Educating all those concerned with the project about the realities of project management.

- Establishing correct time-cost relationship.

- Creation of appropriate standards for work based on suitable work techniques.

- Sharing of project audit information among all concerned, in order to build-up better understanding and better comprehension of the project and its problem areas so that lapses could be avoided in future.

Types of PCA

Different types of Post-Completion Audit are discussed below :

1) Technical Evaluation or Technical Audit :

Technical evaluation refers to the evaluation of quality and quantity of production, the operating costs in production, etc. A comparison of these factors is done between what is presented in the feasibility report/detailed project report and what has been the actual achievement. As regards the rated output, certain projects are expected to give the estimated rated output immediately on commissioning. Such projects can be evaluated, for the variations in output if any, immediately after commissioning. In respect of certain other projects, the output will stabilize only after some time. These are the cases where the output depends upon the quality of raw materials, the skill of the personnel operating the plant, etc.

The operation of the plant is to be studied by varying these parameters and observing the output till the production is stabilized at the maximum level. Evaluation of output can be done only after this, i.e., only after all the inputs are synchronized maximum and the production stabilized. Apart from evaluating the actual output vis a vis the rated output, the other areas of interest are the evaluation of utilities consumed by the plant, like power, fuel, water, steam, consumables, spares, etc. An evaluation of these aspects is made and compared with what was estimated/projected at the time of project appraisal. Technical evaluation also includes evaluation of the quality of the output and checking-up if the quality standards as envisaged are reached.

2) Financial Evaluation or Financial Audit :

Financial projection/estimates are made at the time of project appraisal as to the project cost under various heads, operating cost of the project, maintenance costs, profitability estimates, cash flow and fund flow estimates, sources and application of funds for the project. etc. Financial evaluation is done to verify whether the actual project cost, operating costs, profitability. cash/fund flows, etc., are as per the estimates and projections made at the time of appraisal. While the assessment of actual project cost can be done immediately after the completion of the project, other financial parameters can be studied only after the lapse of say, two to three years since the record of actual operating costs, profits, etc., would be available only after the project is in operation for some time.

3) Economic Evaluation or Economic Audit :

Economic evaluation is the most difficult to make since it involves many subjective aspects which are difficult to be quantified. The evaluator should have an 'eye' for identifying the social costs and benefits of the project. Economic evaluation is more relevant for public sector and community development projects since such projects are undertaken with social objective in apart from financial and other objectives. A public sector project would have been implemented with the aim of achieving certain social benefits. The social costs and social benefits, though subjective in nature, are quantified using some techniques while doing Social Cost Benefit Analysis (SCBA) at the appraisal stage of the project. The project audit from social cost benefit angle should analyze whether the social benefits envisaged are achieved and whether there are any adverse effects that the project has brought in, which were not originally foreseen. Such unforeseen adverse effects have the nature of adding to the social cost of the project. Though SCBA at the appraisal stage has grown into a well laid-out system of appraisal in the in the recent past, post-project evaluation from social cost-benefit angle is yet in an infant stage.

Procedures of PCA

The auditor of the completed project has to be very careful in carrying out the audit. He must follow some procedure so that full justice is done to the work. Some points related to the Post Completion Audit procedure are shown in figure below :

1) Collection of Appropriate Information :

The starting point for collecting post audit information is the project completion report. Post completion audits generally compare the projected data with the accounting data collected through the regular MIS. The MIS needs to be geared up so that the projected cash flows from the original capital budget can be compared with the actual cash flows realized during the period elapsed before the PCA of the project has started. Another point that needs to be kept in mind is that the auditor needs to collect information about the incremental cash flows or cost rather than the total cost figures. Incremental cash now figures are readily available for green-field projects but it is not so easy for the projects in an existing plant. The data in the latter case need to be appropriately dealt with to arrive at the incremental cost figures.

2) Recasting the Data :

Collected data or budgeted data should be recast before they are compared. The significant time gap and a host of factors, which were not considered at the budgeting stage, would warrant the recasting of data. For example, inflation should be adjusted before comparison is made. Sales mix difference doc to external factors also should be taken into account. In the absence of adjustment for those 'external factors, the quality of audit would suffer.

3) Comparison of Projected Financial Parameters with Actual :

This is the next important step in the post completion audit procedure. There are four techniques available for the comparison. The comparison is the starting point from which the real audit begins. Only comparable data is compared. Adjustments are first done for inflation and external factors before comparison is carried out under any method. More than one method may be applied for comparison if there such a requirement. A broad level ROI or NPV comparison can be done initially, followed by detailed cost variance or cash flow variance analysis. Comparison is a step-by-step approach so that causes are identified systematically with minimum cost, time and energy.

4) Establish the Possible Causes of Variance :

Once the variance figures are calculated, if they are significant the possible causes for the same are explored. An auditor goes by exceptions and from there he tries to reach the root causes of deviations. This process of investigation can be effective only if the auditor possesses skills of inquisitiveness and skills of persuasion and negotiation. A summary report of the PCA findings should also be prepared.

5) Final Recommendations :

Once the causes are ascertained the post completion auditor can give his recommendations based on which the manager may take decisions for cash flow forecasting to reinvest or abandon the ongoing project. Hopefully after the post completion audit the cash flow prediction and project evaluation become more accurate.

Techniques of PCA

There are four techniques of post completion audit, namely :

1) Cost Variance Analysis :

In this method only the project cost (actual and estimated) is studied and the revenue aspect is not included in the audit. This approach is adopted when the post completion audit is conducted during the execution or just after the completion of the project.

2) Profit Variance Analysis :

In this method plant-wise profit analysis is carried out by the auditor and the gain adjusted with the inflationary effect is compared with actual. An important point to note here is that even if the aggregates of gains (realized and estimated) are the same there can be wide variations for individual projects, indicating the need for further investigation.

3) Cash Flow and Financial Criteria Variance Analysis:

This method is developed around four schedules. These schedules can provide the management with the information it needs to find engineering, operational and administrative costing faults of past projects.

i) Profit Variance Analysis Schedule :

This schedule is prepared for the calculation of profit variance between projected and the actual project results. The information for the "projected" column is obtained from the approved capital expenditure request. The information for the "actual" column is obtained from regular accounting sources. Supplementary schedules required itemizing and explaining the basis of calculation for revenues, costs and expenses need to be given.

ii) Cash Flow and Financial Criteria Variance Analysis Schedule:

This is used to explain project cash flow and return variances between the projected and actual results. The approved capital expenditure request is again used to provide information for the projected column and regular accounting sources for the 'actual' column.

iii) Project Cash Flow Schedule (Projected and Actual):

These are used to show the projected and actual cash flows of the project. They illustrate the timing of cash flows to compute payback and to provide the net period cash flow information required for the IRR calculation. Each cash flow entry is made according to the time it was projected to be incurred or was actually incurred. The period cash flows are for individual quarters whereas the cumulative cash flows represent all cash flow for the project. The payback point is reached when the cumulative net cash flow equals zero.

4) Present Value Depreciation Technique (PVD) :

Discounting cash flow techniques give only a single value of the NPV which is for the whole life of the project. The IRR is the average return during the life. But at the time of conducting the post completion audit the major part of project life is not completed. A uniform annual series cannot be considered because it is an average figure and the project need offer an NPV at a constant rate over its life. The concept of the present value of depreciation is used in some techniques for the calculation of the year-wise NPV and IRR. 'Present value depreciation' is defined as the decline in the present value of the expected future cash flow during the year using the IRR as the discount rate. Two models, namely, IRR and NPV are suggested under the technique of present value of depreciation.

Benefits of PCA

It should be ensured that people do not consider the PCA as the process for initiating punitive actions, otherwise this will discourage initiative and lead to excessive conservatism and may cause managers to suppress risks projects. The post completion audit should remain educational in nature and purpose is documenting the mistakes for future reference :

- Provide a check on personal biases, improves the quality of estimates, improves the productivity, as estimates become goals.

- Identifies factors due to which projects are not fulfilling their expected promises.

- Provides information for subsequent decision-making and can be used for corrective action is estimates were ever poor, gives a sense of project involvement form the original objectives to final objectives.

- Learning lessons for the future rather than simply fault-finding or fixing blames.

- Precautionary care should be taken to avoid misplaced perceptions about the post completion audit.