What is Business Portfolio Analysis ?

Business portfolio refers to a collection of the different products and businesses that an organisation deals into. Such an organisation can adopt different strategies for their various businesses in the portfolio. For maintaining a business portfolio effectively, an organisation needs to analyze the position of each business separately. This activity is called business portfolio analysis. In other words, the business which maintains the best fit between the company's strengths and weaknesses and the opportunities residing in its external environment is considered as the best business portfolio for a company.

Portfolio analysis is also called corporate portfolio analysis, business portfolio analysis or product portfolio analysis. It is a technique or tool which allows the company to analyze and select the products and businesses and make the necessary strategic decisions regarding them. In order to achieve success in a highly competitive market, the businesses need to analyze their business portfolios so as to decide the level of attention to be given to each business. In this technique, the business first tries to examine the growth cycle of different business units and then tries to match that growth with the growth of the industry in which it resides. This procedure is adopted with an objective of optimum utilization of the resources so that the overall performance of the portfolio can be maximized.

This technique recognizes the businesses in a company that are likely grow rapidly in the future, but are currently constrained due to lack of of resources resources and fulfills the requirement of with the help of highly profitable business units in other mature industries. At times, there are some business units that have completed their life cycle and have no potential to grow further. This technique also identifies those business units so that the business house can divest their money and utilize the resources in more profitable businesses.

Components of Business Portfolio Analysis

Business portfolio is broadly carried-out for each asset at different levels :

1) Risk Aversion :

This method analyses the portfolio composition while considering the risk appetite of an investor. Some investors may prefer to play safe and accept low profits rather than invest in risky assets that can generate high returns.

2) Analyzing Returns :

While performing portfolio analysis, prospective returns are calculated through the average and compound return methods. An average return is simply the arithmetic average of returns from individual assets. However, compound return is the arithmetic mean that considers the cumulative effect on overall returns.

3) Determining Dispersion of Returns :

The next step in portfolio analysis involves determining dispersion of returns.

It is the measure of volatility or standard deviation of returns for a particular asset. Simply put, dispersion refers is the difference between the real interest rate and the calculated average return.

4) Value Maximization :

Allocate resources to maximize the value of the portfolio via a number of key objectives such as profitability, ROI, and acceptable risk. A variety of methods are used to achieve this maximization goal, ranging from financial methods to scoring models.

5) Sufficiency :

Ensure the revenue (or profit) goals set-out in the product innovation strategy are achievable given the projects currently underway. Typically this is conducted via a financial analysis of the pipeline's potential future value.

Types of Business Portfolio Analysis

There are number of techniques that could be considered as corporate portfolio analysis techniques. Some of the commonly used techniques or methods of portfolio analysis are as follows :

BCG Product-Portfolio Matrix / BCG Matrix

The BCG matrix is a model used for analyzing the portfolio of companies. This model was developed during the early 1970s by Bruce Henderson of the Boston Consulting Group. According to this model. the business units of an organisation can be classified into four different categories based on the market growth and market share as compared to the leader in that sector. Therefore, this method is also called as "growth-share matrix". The growth-share matrix measures positions of various business units along these two dimensions.

The BCG matrix seeks to establish a relationship between the products or business units that are highly profitable (cash-generating) and highly unprofitable (cash-eaters). The market growth symbolizes the attractiveness of a particular industry. It should also be kept in mind that the market growth here denotes the growth of overall industry that also includes the returns and profits of competitors. Boston Consulting Group (BCG) Matrix is a technique for estimating a company's position on the basis of its product range This technique helps an organisation to analyze its products and services so that various important decisions can be made about the ones it should invest in and the ones it should divest its money from.

As per BCG matrix, the business units can be classified as high or low on the basis of Relative market share and the Market growth rate. These are described below :

1) Relative Market Share :

According to this model, the more is the relative market share of firm, more is the return. It says that the firm that produces more, enjoys higher economies of scale due to which the experience curve is higher for them, hence these firms exploit the benefits of higher market share. However, sometimes, higher profit is also achieved by those firms that have low production market share.

2) Market Growth Rate :

If market growth rate is high, then there are opportunities for higher returns. However, it also takes more capital to be invested for future growth. Thus, it can be said that those business firms that operate in industries that have a higher growth rate, invest their capital when there are opportunities to grow further.

Four Cells of BCG Matrix

On the basis of the above classification, the firms in an industry can be classified into four types :

1) Stars :

In this block those businesses are placed which enjoy high growth rate as well as higher market share. These businesses are most likely to be in the growth stage of the product life cycle (PLC). These firms pursue an aggressive strategy to expand the market and gain maximum penetration in consumer segments. For example, in India sectors like telecommunications, fast foods, retail, petrochemicals, etc., are some of the businesses which are having a very high growth.

2) Cash Cows :

Cash cows are those business units which generate a lot of cash, but the growth rate of these business units is less. These businesses to the maturation stage of the product life cycle, which enjoy the benefits of its high experience curve. The capital needed to reinvest in the business is quite less than the profit returns. To sustain in this position, the firm needs to implement stability strategies. In this stage, the firms focus on beneficial long-term opportunities and limited expansion.

Since, these are pretty mature firms, hence they gradually their market share as well as their growth rate decline. Due to this, the profitability also decreases At this point, retrenchment strategies are appropriate for these firms. The profit generated from cash cows can be reinvested into 'star' firms and 'question mark" firms, both of which require high resource investment. Some examples of cash cows in Indio are Scooters for Bajaj Auto, toothpaste for Colgate, etc.

3) Question Marks (Problem Child or Wild Cat) :

These are the business units which have a low relative market share even when the industry growth is high. These firms require huge amount of capital to sustain that market share. These are generally y those firms that introduce new products the concept or services in the market with high growth opportunities. According to experience curve, the firm that gains early profits can achieve the cost advantages as well as market leadership. This will create entry barriers for other firms in the industry. In this phase, the firms need decide their future plans. If they feel that they can gain market share, they need to adopt expansion strategies. Retrenchment strategies would also be appropriate in this phase. If sufficient investment is made in the growth of these firms, then these may convert tar firms, or else can also become 'dog' firms if sufficient attention is not provided. In India industries like e-commerce can be called as question marks. These are growing at a very fast but for the majority of players the relative market share is very less. Another example is holiday resorts.

4) Dogs :

These are the firms which have slow growth and have relatively less market share. These neither earn profits, nor require investments. If correlating with the stages of PLC, these firms remain at the stage of late maturity or decline.

Merits of BCG Matrix

BCG matrix provides the following benefits :

- The BCG matrix adds value to portfolio analysis.

- The BCG matrix can be applied to large conglomerates that are interested in benefits from experience effects and volume.

- The BCG model can be easily understood and put into practice.

- It helps in management decision-making.

- The model helps in comparing the growth of different businesses on the basis of industry average. It also helps in checking the portfolio for financial evaluation of the same.

- The ideas behind the model truthful and easily applicable at business and corporate levels.

- The use of the experience curve helps the company to manufacture products that are priced low enough to get market leadership. On becoming a 'star' firm (as per the BCG matrix) the company certainly becomes profitable.

- It is a good and useful guide to allocate the resources of the company for the company or competitors.

- The BCG matrix simplifies business analysis by limiting to just two factors-market growth and relative market share from the variety of factors possible.

- The BCG matrix helps to evaluate the firm's product portfolio in the four categories and helps in framing strategies for the same.

Demerits of BCG Matrix

BCG matrix suffers from the following limitations :

- The BCG matrix over simplifies by categorizing businesses into high and low. However, businesses can vary in various degrees in between these two extreme measures. The two dimensional nature of the model thus does not capture all aspects of the business.

- This matrix does not consider many other important aspects for portfolio analysis, such as competitive advantages, capital requirement, size of market, etc.

- Some aspects of BCG matrix do not represent real situation. For example, the new firms that have low market share or growth are categorized 'dog' firms. However, the real picture entirely different. Sometimes, these new firms show a great potential for growth and capture the market.

Corporate Parenting Analysis

The corporate houses consisting of multiple businesses are structured in such a manner that there is a corporate headquarters which is the center and it has different SBUs or Strategic Business Units that act as its satellites. Therefore, the ways in which these different business units are treated and managed is known as "corporate parenting".

In this concept, the entire corporation is represented as a pool of resource and capabilities that are used for the development of individual SBUs and for fostering coordination and cooperation among the business units. The corporate parenting methodology therefore seeks to address one of the major weaknesses of the corporate portfolio technique.

The corporate portfolio evaluates the business units on the basis of industry attractiveness and looks at individual businesses in terms of their financial contribution. While corporate parenting technique looks at the organisation as a group of different businesses and tries to identify the synergies that are created through the interactions between the parent firm and its business units

According to Campbell, Gold and Alexander a diversified corporation must resolve two issues :

- What are the businesses that a diversified entity should get into and why ?

- What is the organisation structure, procedure, or management concepts that should exist so that the best results are obtained in the corporation's individual SBU ?

In order to identify the appropriate strategy for every business unit, following steps should be completed :

- Estimate each business on the basis of its critical success factors.

- Identify the areas of where there is a scope for improvement in each business unit.

- Scrutinize the strategic fit between the parent firm and its business units.

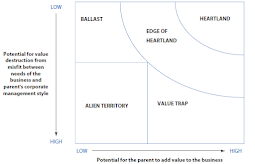

These three steps allow the development of a matrix called the parenting-fit matrix as shown in figure. This matrix has two variables :

1) Positive Contributions :

The positive contributions arise when there is a fit between parenting opportunities and parenting characteristics.

2) Negative Effects :

The negative effects arise when there is a misfit between the critical success factors of the business units and the parenting characteristics.

This analysis gives rise to five strategic positions, each of which has their own ramifications for the corporate strategy. Unlike the portfolio technique which uses factors like the growth potential of the individual businesses and the competitive position, the corporate parenting technique focuses on the strategic fit achieved between the corporate parent and the SBUs.

Positions of Parenting-Fit Matrix

The five positions are as follows :

1) Heartland Businesses :

Heartland Businesses are those in which the parent has a very good understanding about the CSFs of the business unit and it can thus utilize its expertise to make improvements in a particular SBU, Expansion strategies are suitable for the heartland business units.

2) Edge-of-Heartland Businesses :

In edge-of heartland businesses there is a partial fit between the parenting characteristics and the businesses. There are some characteristics which fit and some which do not. The level of engagement between the parent and the SBU increases with the understanding between business units and the parent company. For these business units, expansion strategies will be appropriate if the parent firm can contribute its resources for the development of these SBU.

3) Ballast Businesses :

Ballast businesses are those business units that have a mutual fit with the parent firm, but have rare chances of improvement, in which the parent firm can invest. In a way these similar to cash cows in the BCG matrix, which the mature businesses. Which can still survive, but have little potential to achieve success and can become a constraint for the parent corporation since it can do anything to improve them. It is better to shut down these businesses at the time when it is realized that the cost of production is exceeding the realized profits.

4) Alien Territory Businesses :

Alien territory businesses are those in which there is very little scope of improvement by the parent firm because of the existing misfit between the parents' characteristic and the success factors of business units. Many a times this situation occurs because of unwise diversification strategy implemented the past. Retrenchment is the appropriate strategy. for these businesses.

5) Value-trap Businesses :

Value-trap businesses are those in which there is a good fit between parenting opportunities and the business units, but they suffer because the parent firms do not understand the CSFs of the SBU. At times these businesses show opportunities for growth, but the company cannot exploit them as these opportunities may not suit the competencies of the parent organisation. Therefore, the parent business firm should avoid or retrench these business units.

Thus, it can be said that the corporate parenting technique works with the implicit assumption that the parent has an important role in value addition to the business units.

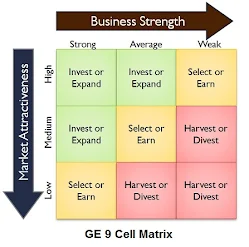

GE 9 Cell Model

The GE-9 cell model or GE business screen is a portfolio analysis technique, which was developed by General Electric Company (GEC) along with McKinsey & Co. of the USA in order to overcome the loopholes of the BCG matrix.

Instead of considering market growth and relative market share as the basis for portfolio analysis, this model considers industry attractiveness and business strength as the basis for classifying the firms. These two factors are further split into three categories, making it a nine cell grid. These cells classify business firms as winners, losers, question marks, average businesses, and profit producers. This model is shown in figure. The strategies for all the kinds of firms are different, such as, the organization should invest its resources in winners and question marks, since the industry attractiveness and business strength both are in favor.

Organizations should also maintain the market position of average businesses and profit businesses though their industry attractiveness and business strengths are average. Moreover, the business units that are at loss should be sold-out as the industry attractiveness and business strength both are not favorable.

For example, Mahindra and Mahindra hived off its M-Seal brand of adhesives to Pidilite industries (makers of Fevicol) as M-Seal was not part of the product strategy of the Mahindra.

The two basic factors considered in analyzing the business units are :

1) Business Strength :

Various factors that are jointly analyzed under the basic factors are profit margin of the products, market share of the business unit, management skills, technology deployed, etc. the quantification of these factors can be done based on the estimation of the strength and importance of other factors for achieving success. The strategists can rate the strength and importance as per their personal experience.

2) Industry Attractiveness :

Many factors are needed to be studied for analyzing the industry attractiveness, such as, industry growth rate, profit margin of the industry, seasonal and cyclical trends of the industry, economies of scale, entry and exit barriers, technological development, legal and social factors, etc. These factors can also be quantified in a similar manner in which the business strength factors have been estimated.

Differences Between GE 9 cell and BCG matrix

There are two basic differences between GE 9 cell and BCG matrix :

- The GE model considers two basic factors, i.e., industry attractiveness and competitive position, which are further divided into three factors, instead of only two factors in BCG matrix, i.e., market. growth and market share, making it a simple model.

- The GE model analyses the variables at three levels, i.e., high, medium, and low, whereas the BCG model considers only two levels, i.e., high and low.

Zones of GE-9 Cell Model

The nine cells of the GE matrix are divided into three zones and represented by the colors green, yellow and red, which are similar to the traffic signals. Hence, these colors are interpreted in the similar ways, i.e., green represents 'go', yellow represents 'wait', and red represents 'stop'. Due to this similarity, GE model is also called as the "spot-light strategy matrix". Each of these zones suggests a particular strategy to be followed by the organizations, which are as follows :

1) Invest/Expand :

This is the first zone, which is represented by green color, and hence called as "green zone". In this zone, firms have both the industry attractiveness and business strength in different degrees. This is the favorable situation for business units, but the business units do not remain in this situation for a long time as other firms get attracted to the industry. But this can be maintained by creating some entry barriers. An example of this is the fast food business. Earlier few fast food comers were there in India, such as McDonalds, Dominos, etc. But, gradually, numerous players have entered in the market such as KFC, Pizza Hut, Bikanervala, etc.. making this industry less attractive these days.

The important strategy for the firms in this zone is to invest and expand their businesses. It is clear from the figure that in the upper left corner, both the industry attractiveness and business strengths are high, which is an ideal position. However, the other two cells represent realistic business situations. The middle cell of the top row indicates high industry attractiveness and average business strength. The firms which belong to this cell would grow in the long-term. Though, if the firm does not improve its strength, then the situation may prove to be unfavorable in future. For example, many players have entered the e commerce market in India looking at the attractiveness of the industry.

However, most of the players have average business strengths. Another situation, where the business strength is relatively higher and industry attractiveness is average represents the most realistic scenario. Since, the firms that belong to this cell have strength, therefore these firms can develop a competitive advantage, which in turn may act as an entry barrier in the industry. This explains the rise of companies like Reliance in the polyester and polymer businesses which were not very attractive, but Reliance was able to get a good market share due to its competitive strength.

2) Select/Earn :

This situation represents the middle or mixed situation for the company. Not much. growth opportunity exists, but the organisation has the opportunity to do selective earning. This happens because either one of two parameters of business strength and industry attractiveness are at high or middle level. The two situations of average strength and medium attractiveness and strong strength and low attractiveness indicate a strategy of hold i.e., to earn the profits at existing capacity with no additional investment. In the situation of high industry attractiveness the company has a flexible option. High industry attractiveness, low strength indicates and opportunity for the organisation. However, if the organisation is not able to build its business strength, then it makes sense to leave the business as the business is likely to turn into a "question mark. Similarly, in case of strong strength and low industry attractiveness, the company can opt for backward or forward integration. A company can also diversify into other industries where it is able to utilize its business strengths.

3) Harvest/Divest :

This is the third zone also called "red zone". The cells, which come under the zone have average strength and low attractiveness, or average attractiveness and weak business strength. For these firms, harvesting is the appropriate business strategy. In harvesting, the company quits the business but withdraws gradually. quits the In this situation, the initial emphasis is on reducing the costs by stopping those activities that have long term business influence, such as research and development, advertising, etc. The entire thrust of the organisation in these cases is to earn short term profits as the business does not have a long term horizon. One thing that should be kept in mind that the business units with low strength and low industry attractiveness should immediately be stopped and the company should divest its capital.

Merits of GE-9 Cell Model

GE-9 cell matrix has following advantages :

- GE-9 cell model offers a classification into medium and average ratings which the BCG matrix does not with the rather simplistic classification of high and low.

- It also considers many factors like market share, industry size, etc.

- It is also a very powerful strategic technique that channelizes corporate resources to businesses and categorizes them as per medium to high attractiveness and the medium to high business strength

- It also utilizes many factors while framing the two variables of industry attractiveness and business strength.

Demerits of GE-9 Cell Model

Besides various advantages, GE-9 cell matrix has the following disadvantages :

- It can become quite complex with increase in size of the business.

- Industry attractiveness and business strengths are subjective variables and differ from person to person.

- New business units in a developing industry cannot be analyzed through this model appropriately.

- It rather than specifying the business policies provides strategic prescriptions.

Advantages of Business Portfolio Analysis

The advantages of portfolio analysis are as follows :

1) Identifies Performance of Assets :

The key advantage of portfolio analysis is that it helps the investor to see how the various assets under his control are performing. By dividing the assets into asset categories and sub-categories, the technique is able to identify which of the assets are performing well and which are not. Therefore, the investor can plan which assets he wants to keep and which he wants to remove from the portfolio.

2) Provides a Review of Past Performance :

The portfolio analysis also allows the investor to see how the asset classes have performed in the past. It is also possible to see how the asset classes have performed with the changes in the economy and other macro variables with the help of portfolio analysis. Historical data can also be shown in terms of a graphical representation.

3) Allows Comparing the Portfolio :

The portfolio analysis also allows the investor to compare the performance of his portfolio with other comparable asset classes.

4) Identifies Exposure :

Portfolio analysis allows the investor to identify areas where he has invested most of the capital. The areas where there is a greater exposure of resources, the likelihood of a financial exposure is more in those areas. It facilitates the investors to balance-out his capital in different areas for distributing the risks.

5) Simplifies Complex Situation :

The portfolio analysis technique helps the investor to analyze the complex situations and analyze the strengths and weaknesses of the organization's portfolio of products and businesses.

6) Acts as a Good Returns Mechanism :

This technique helps as a medium to deliver superior returns to the shareholders of the organisation in medium to long-term.

7) Helps in Risk Identification :

Since the portfolio analysis technique identifies areas where the company can have greater exposure, it also helps in identifying the risks associated with the company portfolio.

8) Identifies the Industry Trends :

The technique identifies trends in the industry beforehand and seeks to achieve a high level of profitability before the product or the industry reaches the decline stage

Disadvantages of Business Portfolio Analysis

The growth of a business typically proceeds by the launch of new products or by its entry into new markets or both Portfolio technique helps the managers to judge the profitability of the various businesses of the organisation based on certain parameters. It helps them to allocate scarce resources amongst various competing businesses and bring about optimum utilization of the same, so that the investments generate the best returns for the organisation. Portfolio analysis has certain limitations which are described below :

1) Frequent Changes :

Portfolio analysis does not provide short-term utility. When Portfolio analysis is done in a short-term, it can lead to frequent and costly changes in the company's resources.

2) Complex and Time-Consuming :

Acquiring new businesses and removing the older ones can be both a difficult and time consuming activity. The costs involved in these can be substantial and should be taken into account before acting on the suggestions based on portfolio analysis.

3) Does not Always Provides Appropriate Analysis :

Portfolio analysis does not always provides appropriate judgement. Many times it is seen that the firms with low market share also perform better, which is not true as per the portfolio analysis technique.

4) Does not considers Synergies :

Portfolio analysis techniques do not generally consider synergies across the business or its products. The portfolio analysis technique treats each business as a standalone business and ignores the coordination and cooperation that exists between them.

5) Difficult to Define and Categorize Products :

The entire technique of portfolio analysis depends on segregating the products and businesses of an organisation into various categories. However, the process of defining and categorizing businesses is quite subjective and hence lacks objectivity.

6) Forecasting :

Portfolio analysis depends upon the past financial data on the basis of which future of the business units is forecasted. Heavy reliance on the financial data may lead to erroneous results.

7) Ignores Interaction between Products :

There it a lot of interaction between the performance of different products and this is often inter-related These relationships between products are complex and are typically ignored by the portfolio analysis technique which uses profit potential as a yardstick to categorize the businesses.

8) Alternative Investments :

Since portfolio analysis only looks at the current products and services of the organisation, it ignores possible alternatives where the resources of the organisation can be better employed. For example, the company can increase its rate of return by investing in a new technology rather than investing the same in its current product mix.