What is Venture Capital ?

The term venture capital consists of two words 'venture' and 'capital'. Venture implies a course of action with uncertain outcomes including the risk of loss. Capital denotes resources to move and run the projects. Thus, the term can be defined in two different ways i.e., in the narrower sense and broader sense.

In the narrower sense, the capital used for financing a new business project may be termed as venture capital. It deals with offering funds, to growing companies. In the broader sense, venture capital involves investing in the long term equity finance on which the return is obtained by the way of capital gain. It is assumed that the entrepreneur and the venture capitalist work as partners.

Venture capital may be equity or equity related investment and is generally deployed in growth oriented small or medium scale business. This is done to enable developers to accomplish their vision. Venture capital is a complex type of private equity investment.

Definition of Venture Capital

According to 1995 Finance Bill :

"Venture capital is defined as long-term equity investment in novel technology based projects with display potential for significant growth and financial return".

Features of Venture Capital

Following are the main features of venture capital financing :

1) New Ventures :

Venture capital is generally invested in new business which use cutting edge technology for offering better services or producing new goods. Their motive is to attain high growth and generate substantial returns.

2) Continuous Involvement :

Venture capitalists not only provide funding but they also offer managerial guidance and technical skills to mentor the business clients.

3) Mode of Investment :

It is a type of equity financing. However, it concentrates on business which are too new for the stock markets to raise funds. This type of financing can be in the form of convertible debt or loan financing to ensure that the investment portfolio of the venture capitalist shows a regular yield.

4) Objective :

The main aim of a venture capitalist is to earn capital gain at the time of exit. In case of debt financing, the main aim is to get regular returns. It is a long term capital investment and introduce specially into new small and medium business with high growth potential.

5) Hands on Approach :

Venture capitalists take proactive interest a business they invest in. They provide various services such as mentoring and managerial skills, technical skills, loans, etc. However, they do not acquire majority or controlling interest. They also do not interfere in day to day management.

6) High Risk-Return Ventures :

Venture capitalists are interested in high returns which come with high risk profile. Venture capitalists make gains through capital gains at the time of exit.

7) Nature of Firms :

Venture capitalists invest in small and medium scale firms and industries in their early stage. The financing is provided until they are in maturity stage to obtain funds from industrial financial markets. These firms are generally innovative and technology-oriented.

8) Liquidity :

Liquidity of venture capital investments is totally based on the success of the new projects. It is highly liquid if the business turns out to be profitable.

Methods of Venture Capital Financing

The Methods / Sources of venture capital are as follows :

1) Equity Financing :

Venture capital undertakes basically deployed funds in the form of equity share capital for a longer period. This method of financing does not provide returns to the investors in the initial stages. There should be maximum of 49% shares in equity contribution in the venture capital company for maintaining the proper control and ownership with the entrepreneur.

2) Conditional Loan :

The conditional loan is repaid as royalty if the venture produces sales. and there is no interest paid. The venture capital financiers royalty, between 2% to 15%. The various other factors like cash flow patterns. gestation period, riskiness, etc. is considered for fixing the actual rate. The venture capital financier gives choices to the company for paying a high rate of interest that may be 20% in place of royalty on sales after it starts earning profit.

3) Income Note :

Income Note has the mixe features of both the conditional loan and conventional loan. The venture capitalist has to pay both the interest and royalty on sales at the lower rate.

For example, the venture capital financing of IDBI provides funds which equals to 80-87.50% of the cost of the project for commercial use of original technology.

4) Participating Debenture :

The participating debenture charges interest in three steps; in the first step, there is no interest charged. In second step, there is low rate of interest charged to some point and in the last step, the rate of interest kept is very high.

5) Other Financing Methods :

Basically, in the private sector the venture capitalists have introduced other financial securities like participating debentures, introduced by The Community of Financial Corporation (TCFC) etc.

Exit Strategies of Venture Capital

Exit mechanism of venture capital is of four types :

1) Initial Public Offerings (IPOs) :

The venture capitalists provide their share holding to the public only when the company is in the position of earning the profit and the market conditions are also favorable for them. The basic benefit of the exit route is that the price of the share is set according to the market position. There are also some limitations like high cost of issue, lower demand etc.

2) Acquisition by Another Company :

The company also adopt the strategy of selling their holding to another company which wants to expand their business. In this the companies can change the terms and conditions of the agreement and do the business on the agreed price. There will be hostile takeover if there is transfer of controlling the interest and existing promoters is not agreeing to do so. There are also the chances that the business of the acquired company may go down due to the had goodwill of the acquiring company.

3) Repurchase of the Venture Capitalist's Share by the Investee Company :

The promoters can get their control back by buying the shares from the venture capitalists. The venture capitalist can also ask for compensation for exiting from the business if the company is earning high profit.

4) Purchase of VC's Share by a Third Party :

The venture capitalists if required can sell their holdings by the help of private placement one or more third parties due to which there is chance t that the existing promoters may lose their control. Thus, it will be cheaper route of exit as compared to the public offer.

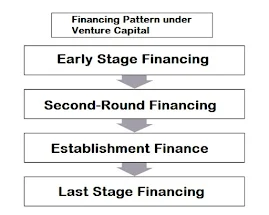

Financing Pattern under Venture Capital

The stage financing is the specific plan used by the venture capitalist. The venture capitalists require sufficient amount of financing in the four successive stages for the establishment of the business like idea generation, start up, emerging and establishment to attain economies of scale and stability. The risk is reduced by the help of stage financing. There are four basic stages for making the project. Types of venture capital are as follows :

1) Early Stage Financing :

i) Seed Capital :

The capital required to start a business is called seed capital. It is the first stage of project development which requires the small amount of capital to be given to the entrepreneurs for the concept testing and converting an idea into business. The seed capital is collected from the personal assets of the founder, friends and family. The requirement of money is small because the business is at the stage of idea generation. This kind of venture is usually at the pre revenue stage and seed capital is required for research and development, for protecting the initial operating expenses till a product or service will start making revenue and for attaining the interest of the venture capitalists.

ii) Start-Up Finance :

In the second stage, there is the provision of providing the finance to the unit by the venture capitalist for producing the product.

iii) Additional Finance :

In the third stage, the additional finance is required for meeting starting expenses if the firm is not able to produce funds for bearing the working capital needs.

2) Second-Round Financing :

This kind of financing is needed at the stage when the product is being launched in the market because at this stage, the business is unable to present the shares to the public as there is no profit earned by the company. At this stage, the promoter will invest his own funds the proper help will be given by the venture capitalist as required for the expansion and diversification will lead to attainment of economies of scale and stability. The venture capitalists will require large capital as compared to the early stage of financing.

3) Establishment Finance :

Establishment finance is required for varied purpose such as for growth, capacity expansion, marketing and working capital.

4) Last Stage Financing :

Financing in the last stage is required for the establishment of the business and also for extra financial support because the firm is not ready to go for public offer as it has not reached the profit earning stage. It consists of the following types of capital:

- Development capital

- Bridge/expansion capital

- Management buyouts

- Management buying

- Turnarounds

Advantages of Venture Capital

Following are the main advantages of venture capital financing :

- Venture capital funding can offer large amount of equity financing to the company. It also offers expertise and mentoring to their clients.

- Venture funding makes it easier for the business to seek funding from additional sources.

- Venture capitalists also participate in economic growth.

- Venture capitalists help in promoting new and innovative business ideas which may not have been implemented due to lack of funding.

- It encourages the entrepreneurs to take risks and innovate.

- Venture capitalists benefit from economies with high growth rate.

Disadvantages of Venture Capital

Following are the main disadvantages of venture capital financing :

- Venture capital financing involves complex and tedious process.

- A detailed business plan needs to be prepared which may be expensive due to engagement of professionals and experts of that particular field.

- It also entails high accounting and legal fees during the negotiation stage for securing capital funds.

- Venture capital may take away the management control from the entrepreneur.

- Venture capitalists may also demand share in profits for investing the funds.

Growth of Venture Capital in India

The pre-liberalization and post-liberalization are the two stages for the growth of industry in India. In 1991, the first liberalization process was started. In the early 1998, the requirement of venture capital was felt due continuous economic reforms. In the same year. Technical Development and Information Corporation of India (TDICI) now known as Industrial Credit and Investment Corporation of India (ICICT) was set up along with Gujarat Venture Finance Limited (GVFL) which were promoted by financial institutions. The various sources of these funds are financial institutions, foreign institutional investors or person funds and high net worth individuals. Thus, various efforts were made for raising funds from the public and fund new ventures. The venture capitalists cannot change the economic conditions till now.

Thus, it was seen that the venture capital funding is required to be established and controlled in the better manner. The venture capital funding will need different skills in determining the proposal and also checking the development of the fledging enterprise. In 1996, which was the starting of second phase of growth of venture capital, the Securities and Exchange Board of India gave the guidelines for venture capital funds for helping in the various activities in India. It funds helped in the liberalization of industry from various numbers of bureaucratic problems and also opened the way for the foreign funds into India. The increase in the competition leads to better access to capital and professional business method for the better working of the markets.

There is various number of funds working in India which give financial assistance to start the business. Basically, all are not venture funds as there are many which only act as point of connection between the funds and start-up venture. They are known as the private equity. The private equity players had occupied the Venture capital market in India. The Indian industry now can withstand the global competition by the help of venture capital which will provide financial assistance to various other entrepreneurs so that they can also enter the market.

The economic liberalization in India was started in 1980 where new financial products and services were introduced for assisting the growth in the industrial sector. The venture capital financing has led to increase in the number of entrepreneurship and use the technological ability in India. The various organisations which act as the foundation of venture industry in India are as follows :

1) Risk Capital and Technology Finance Corporation Limited :

The Risk Capital Technology Finance Corporation Ltd. (RCTFC) having authorized capital of 25 crore and a paid-up capital of 250 crore was started in January 1988 on the restructuring of the Risk Capital Foundation. It was sponsored by IFCI in 1975 for meeting the risk capital requirements of the first generation entrepreneurs. It helps in giving risk capital and venture capital assistance and also provides conventional loans and interest-free conditional loans on a profit and risk sharing basis with the project promoters.

2) IDBI Venture Capital Fund :

The Government of India formulated Research and Development Act 1986 which charged and collected tax of 5% on the payment done for import of technology. The fund is collected to give financial help to the industries which worked on an imported technology for increasing the domestic scope. The venture capital fund was built by long-term fiscal policy of the Government with an initial capital of 10 crore for giving the equity capital for building plants. The scheme was started the later half of 1987 and according to this scheme, the equity fund was disbursed without interest and voting rights. The minimum and maximum project help was in between Rs.5-2.5 crore. The contribution for venture below Rs.50 lac is 10% and for above 50 lac is 15%. It gives financial help to the ventures which are working in the fields like chemicals, computer software, electronics, biotechnology energy, food products and medical equipment's.

3) Technology Development and Information Company of India Limited (TDICI) :

The Technology Development and Information Company of India Limited (TDICI) was made in July 1988 which was the first venture finance company of India. It was promoted by ICICI and UTI according to the Companies Act, 1986. It started its working from August 1988 after taking up the venture capital operations of ICICI. The initial authorized capital was 220 crore which was increased to 740-50 crore. TDICI provided equity conditional loans, convertible loans and modern technology information service to the small and medium industries which are owned by technocrat entrepreneurs. TDICI had the first venture fund of 20 crore which was subscribed equally by ICICI and UTI. It was the first fund floated for giving the venture capital to entrepreneurs in the country and also is the part of venture capital unit scheme with the help of UTI. The ICICI and UTI in January 1990 has jointly made the second venture for Rs,100 crore. It gives financial help to the projects of professional technocrats which does an initiative planning and making indigenous technology in the country. The basic target is on the small and medium-sized unlisted companies with the increasing growth and capital. It provides financial help to the firms which will develop information technology, pharmaceutical, veterinary biological, environmental, engineering and other innovative services in the country.

4) Indus Venture Capital Fund :

Indus Venture Capital Fund with a capital of 2 crore is the private company formed by several Indian and foreign companies to provide venture capital funds to the firm present in India. Indus Venture Management manages the investment of fund by a separate company. It provides) help to both equity capital and management support to the entrepreneurs. The International Finance. Company has recently invested $1.58 million for helping the establishment of privately managing venture capital funds. The Indus Venture Management Limited owns to the limit of 35% by private sector and international companies had 30% and 35% of the Government of India. Thus, it cannot be more than 10% of its funds in one project and will take up to 50% of the project equity. The basic objective is to get long-term capital gains by equity investment, high risk and high return investment in private companies. It helps in providing financial help to the firms working in the field of health care products, electronic and computer technology.

5) Small Industrial Development Bank of India (SIDBI) :

SIDBI had established a venture capital fund in July 1993 for helping small sector entrepreneurs. In future, the fund would improve according to the requirements.

6) Gujarat Venture Finance Limited :

Gujarat Venture Finance Limited (GVFL) whose total size of the funds is 24 crore, was formed in July 1990 to give financial assistance to the venture. It was promoted by GIIC, IDBI, the World Bank, commercial banks, SFCS and private corporate bodies. The maximum and minimum range of finance is between 2 and 2.5 crore. It helps by giving venture financial assistance in the form of equity and quasi-equity instruments and also provides management support to the entrepreneurs. The GVFL finance biotechnology, surgical instruments, conservation of energy and food processing industries.

7) Credit Capital Venture Fund :

Credit Capital Venture Fund was set-up in April 1989 and was the first privately managed venture capital. The subscribed capital range from 76.5 crore to 10 crore by the help of public subscription.

8) Andhra Pradesh Industrial Development Corporation (APIDC) :

APIDC Venture Capital Limited was formed on 29th August 1989 with contribution of APIDC which had an authorized capital of 2 million. The basic aim was to increase the technology-based ventures introduced by first generation technocrat entrepreneurs and venture which has the high rate of risk in the State of Andhra Pradesh.

9) 20th Century Venture Capital Fund :

The 20th century venture capital fund was formed by the contribution of 20th Century Finance Ltd with capital of 20 crore. It helps the sick industries and first generation entrepreneurs.

10) State Bank, Canara Bank, and Grindlays Bank Venture Capital Funds :

The SBI capital market (SBI cap) was made by the merchant banking subsidiary of SBI. It helps the new and unknown companies by investing in their equity share. The Canara Bank financial service was formed by the Canara Bank. Grindlays bank is providing the venture capital funds to the high risk projects.