What is Forfeiting ?

Forfeiting has been abstracted from the French word "Forfeit" which means "to surrender something or give up one's right". In mid 1960, the theory of forfeiting was first introduced in Switzerland. Its importance has grown after the end of Second World War for assisting finance to the West German export to eastern block countries.

The exporters engaged in forfeiting give their rights to the forfeiter for getting future payment from the buyer to whom goods are given. The exporter gives the credit terms to the importer and sells the debt to the forfeiter. Thus, if the importer is unable to make the payment then the forfeiter gives up the option to the exporter. In other words, forfeiting is known as a method to assist the exporter to sell the goods in credit and also gets the cash before the due date.

Forfeiting is the way of financing the receivables, related to international trade. It shows the purchase of trade bills, promissory notes, etc., by various bank and financial institution without giving option to the seller. The purchase is done by discounting the bills which protects the overall risk of non-payment in collection. The forfeiter has the responsibility of bearing all risks and collection problems. The forfeiter makes the cash payment to the seller after discounting the bills and notes.

Features of Forfeiting

The features of forfeiting are as follows :

- Forfeiting consists of true procedure related to finance.

- Forfeiting is related to the long-term receivables which are of more than 90 days.

- The total value of promissory note and treasury bill is discounted by a forfeiter. Hence, financing has the 100% financing arrangement of receivables finance.

- In the forfeiting arrangement, the availing bank is an important element which gives the guarantee without any conditions and is always fixed. The financial decisions taken by forfeiter depends on the financial status of the availing bank.

- The forfeiting provides finance to the promissory notes and treasury bills coming from the deferred credit transaction ranging from 3 to 5 years.

- A forfeiter by charging a premium protects from exchange rate fluctuations.

- The forfeiter can either hold the promissory notes and treasury bills till maturity for payment by the importer's bank and can also sell them in the secondary market.

- The forfeiting can either be structured on fixed interest rate or on floating rate basis. It can be made suitable for holding various changes according to the credit period, shipment schedule etc.

- Forfeiting is appropriate for expensive exports and less expensive goods which are of same type The expensive goods includes capital goods, consumer durable, vehicles, consultancy and construction contracts, project exports and bulk commodities and less expensive are pharmaceuticals, dyes and chemicals, cotton textiles and yarn, leather and garments, granite, handicrafts and carpets, etc.

Process / Mechanism of Forfeiting

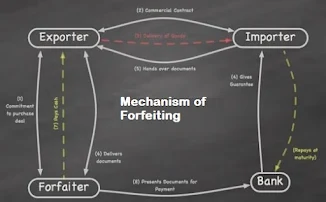

The explanation of working or mechanism of the forfeiting along with the figure shown as follows :

- The forfeiter gives the exporter a written agreement to purchase the debt from exporter without recourse basis on the appeal of exporter.

- The commercial contract is signed by the exporter and importer.

- The authorized dealer (AD) gives the forfeiting certificate along with the goods received before giving it to the customers. The commercial contract acts as the base for other shipping documents. After this the goods are sent to the importer.

- The importer requests the bank to give guarantee.

- The importer moves the guarantee to the exporter.

- Then the exporter gives the guarantee for the forfeiter and moves the other forfeiting documents.

- The exporter receives the payment from the forfeiter after receiving the complete documents on a without recourse basis.

- The forfeiter gives the documents for the payment after the maturity to the bank of the importer.

- The payment is given to the guaranteeing bank by the importer.

- The payment is given to the forfeiter on due date by the importer's bank guaranteeing the transaction.

Forfeiting Charges / Cost of Forfeiting

The various costs and charges related to forfeiting are as follows :

1) Discount Fee :

Discount fee is the interest paid by the exporter for the whole credit period and the forfeiter deducts from the amount paid to the exporter from the used promissory notes or bills of exchange.

2) Option Fee :

The option fee is paid for giving the right to the exporter for leaving the forfeiting contract. The special charges are charged as the one-time cost on every forfeiting transaction.

3) Collection Costs :

The collection cost is paid when the receivable is matured by the forfeiter.

4) Commitment Fee :

The commitment fee calculated as a certain percentage per month on financing the total for the period of commitment and it is paid for the period between the signing of the forfeiting agreement and payment to the exporter. If the exporter unilaterally fails for obeying the forfeiting contract then a penalty will be charged.

Advantages of Forfeiting

The advantages of forfeiting are as follows :

1) Simplicity and Flexibility :

Forfeiting is simple and flexible process. The fulfillment of the requirements of the exporters and importers is the service given by the forfeiting. It is used financing the export and is also used in the medium-term fixed rate financing.

2) Non-Recourse Basis :

The various financial transactions in the forfeiting are on non-recourse basis so it helps the exporter to change their credit sale into cash sale.

3) Fixed Interest Rate and No Currency Risk :

Forfeiting is known as an export facilitator as it has a fixed interest rate and no currency risk by the bank of the exporter gets the additional credit limit for particular time period.

4) No Need to Carry Receivables :

Forfeiting helps the exporter to eliminate receivables from the balance sheet.

5) Involvement of EXIM Bank :

The EXIM bank is involved instead of the exporters for dealing with the forfeiter.

6) Reducing the Problem of Due Collection :

By the help of forfeiting, the problem of the exporters for collecting the dues of the sold item is out of transaction.

7) Simple Documentation :

The process of documentation is easy and simple which helps in giving the chance for structuring the deal.

8) Measure of International Risk :

The forfeiting is a better method for measuring the international risk because of which the Indian banks gives discount on the bills of foreign customer without adding their name.

Now, forfeiting is also used for the small export orders along with the capital goods in which there were dealing from the past.

Disadvantages of Forfeiting

The disadvantages of forfeiting are as follows :

1) High Interest Rates :

As the forfeiting covers the various kinds of risks which make them charge high interest rates.

2) Unfavorable Exchange and Administrative Controls :

In various countries, the forfeiting is not followed because they do not support the exchange and administrative controls.

3) Reluctant Importers :

The importers do not give guarantee for helping in forfeiting.

4) No Legal Framework :

The forfeiting does not have any legal framework due which no protection is given to the banker or forfeiter. There is some protection provided from the existing covers for the risk related to foreign transactions.

5) Insufficient Data :

The data related to various forfeiting companies on the credit rating agencies, foreign country is not enough. The EXIM bank does not give it service to high-risk countries like Nigeria.

Difference Between Factoring and Forfeiting

|

Basis of Difference

|

Factoring

|

Forfeiting

|

|

1) Nature

|

Factoring is on-going and revolving facility.

|

Forfeiting is structuring and costing according to the customer or

situation based.

|

|

2) Control of Sales Ledger

|

Under factoring, the factor handles the entire sales ledger at a

predetermined price. Factoring requires the assignment of whole turnover with

a buyer on a continuous basis.

|

In forfeiting, the complete sales ledger of the exporter is not

controlled by the forfeiter.

|

|

3) Recourse /Non- Recourse

|

The factoring is done with recourse or without recourse according to the

terms of transaction between the seller and factor.

|

The forfeiting is pure financing without recourse to the exporter.

|

|

4) Parties Involved

|

There is the export and import factor in international factoring.

|

There is a forfeiter and bank involved in the transaction in forfeiting.

|

|

5) Cost Bearer

|

The cost of factoring is usually borne by the seller.

|

The cost (charges) consists of three elements like discount rate,

commitment fees and handling fees, which is borne by the importer in

forfeiting.

|

|

6) Term of Maturity

|

The transactions of short-term maturity not exceeding six months in

factoring.

|

The transactions of long-term maturity periods ranging between 90 days

and up to 5 years in forfeiting.

|