What is Financial Market ?

Finance is considered to be one of the most important ingredients of the contemporary business. Financial markets comprise of the entire institutional set-up in place, which primarily deals with various financial instruments, including credits extended in the form of cash, cheques, bank deposits, bills, etc.

A financial market offers a platform for individuals, various entities, and institutions to enter into trading activities in respect of different financial instruments (such as equities, debentures, bonds, etc.), commodities (such as gold, silver, and other precious metals, or agricultural produces) and other items/goods of fungible nature. Such offer is made available at a reasonable transaction cost, which represents an efficient-market hypothesis.

Financial market is a meeting ground for the market players, viz. the buyers and the sellers interested in trading in various financial instruments and commodities are gathered together. Markets may be classified into two categories,

- General market, where different kinds of instruments and commodities are traded and

- Specialized market, which is meant for trading in specific instrument/commodity.

Financial markets may be domestic or international depending upon the activities undertaken therein and the participants thereof. Following activities are facilitated by the markets :

- The raising of capital (platform for which is the capital market).

- The transfer of risk (platform for which is the derivative market).

- International trade (platform for which is the foreign exchange market).

Functions of Financial Markets

Financial markets are expected to perform the following functions :

1) Mobilization of Savings and their Channelization into more Productive Uses :

Financial markets encourage people to save more, as they act as a conduit for channelizing household savings. Appropriate use of idle cash is ensured by deploying them at places where they are required most. They also provide suitable returns to the investors. This process is carried out through the help of a number of financial instruments, which are designed to cater the needs of various categories of investors.

2) Facilitates Price Discovery :

The determinants of the price of any goods or services are the market forces, viz. demand of a specific product or service and supply thereof in the market. The same principle is applicable in the cases of financial instruments, i.e. their price is also determined by their demand and their availability. An investor may, therefore, make an attempt from time to time to ascertain the price of the financial instruments held by him. The financial markets are facilitators of such price discovery in respect of goods, services, and securities.

3) Provides Liquidity to Financial Assets :

Markets are the places where the market players (traders in various commodities, including securities) are present for entering into appropriate actions, i.e. buying or selling commodities/securities. In view of the above, securities continue to be liquid; it means they can be bought or sold easily. This factor elevates the confidence of the existing as well as potential investors.

4) Reduces Transactions Cost :

At the time of taking a trading decision (buying or selling), a host of data/information is required by the trader. Gathering such data/information from different independent sources is a challenging task, requiring a lot of time and money. However, such data/information are readily available in the financial markets, which can be obtained without much loss of time and money. As a result, the cost of transaction is kept at the minimum possible level.

5) Assist in Maintaining Balanced Economic Growth :

Financial markets are important links between the investors on one hand, and savers on the other. Therefore, they facilitate economic growth of a country in a balanced manner. They are also an effective medium through which resources are distributed among-st those who require them. In the process, technological up gradation for the purpose of growth takes place on a regular and sustainable basis.

Features of Financial Market

Financial markets are characterized by the following Features :

1) Large Volume of Transactions :

One of the salient features of the financial markets pertains to the high level of transaction volumes, and the pace at which various financial resources can move between different markets.

2) Various Segments :

Financial markets are composed of a number of sub-divisions, e.g. equities market, debts/bonds market, derivatives market, etc. Each of such sub-divisions may be further divided into the primary market and secondary market. Investment decisions are generally taken by the savers on the basis of risk perception and benefits accrued there from.

3) Instant Arbitrage :

Due to the fact that there are a number of markets and a number of financial instruments in existence, there is enough opportunity for quick arbitrage, if a proper check is kept on the market movements.

4) Volatility :

Movements of financial markets are unpredictable, as they are quite sensitive to any political/economic development, either domestic or global. Any negative/positive development in the political/economic arena or even in respect of a specific company/group of companies may impact the markets either way. Instances of distress selling or panic buying are common place news in markets.

5) Dominated by Financial Intermediaries :

Most of the major/big players in markets are financial intermediaries; they take investment decisions on behalf of their clients: At times, the risks involved in those investment decisions are also borne by such intermediaries.

6) Negative Externalities :

Another hallmark of the financial markets is their association with negative externalities. Any negative development in one of the market segments is likely to have a contagious effect not only on other financial market segments, but also on non-financial markets.

7) Integration with Worldwide Financial Markets :

Of late, the domestic financial markets and the global financial markets are under the process of assimilation with each other. Any positive or negative sentiment of one market is bound to impact the other one. As a result, markets do not operate on standalone basis anymore. Sub-prime crisis of USA (2008) is a burning example of such integration.

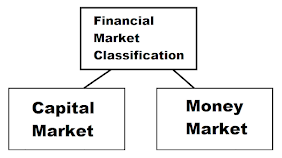

Types of Financial Market

Financial markets may be classified into the following categories. Such categorization has been made on the basis of the tenure of credit requirements and the functions carried out by such markets :

1) Capital Market :

Capital market is an important segment of any financial market. Financial assets/instruments having long-term maturity, generally more than one year, are dealt with in this segment. Financial instruments having maturity of less than one year are referred to as money market instruments, and are dealt with in another segment of financial market, i.e. money market.

Capital market may be divided into two components, viz. primary market and secondary market. While the new issues of equities or debt instruments are dealt with in the primary market, the secondary market deals with the trading of existing or earlier issued instruments.

Another way of classifying the capital market may be dividing it into stock market (which deals with the equities) and bond market (which deals with the debt instruments).

2) Money Market :

Money market is another segment of the financial market, in which the financial instruments characterized by their high liquidity and short maturities, are traded. The participants of this market use it for short-term borrowing and lending; the short-term being in the range of 'overnight' to 'under one year'.

Advantages of Financial Market

A pivotal role is played by the financial markets in channelizing the peoples' savings and diverting the same for the purpose of various economic activities, like manufacturing of goods and provisions of services. 'Cost of credit' and 'return on investments' are the two important indicators/factors impacting the player of the financial markets (i.e. manufacturers and consumers). They facilitate channelization of funds from those who have surplus, i.e. household/business savers to those who needed them, e.g. individual consumers, business entities, governments, investors, etc.

Similarly, comprehensive and vibrant financial markets coupled with the presence of financial institutions creates an environment, wherein smooth flow of funds takes place between different countries. The financial markets are advantageous for investors as well as the corporate in the following manner :

1) Advantages to Investors :

- Buyers and sellers of various securities are brought together by providing them with a common platform, which in turn ensures the marketability of securities. In other words, buying and selling of securities can be done conveniently, without any hassle.

- The prices of various securities are disclosed/quoted on a regular basis by the stock exchanges in a transparent manner. This gives an opportunity to the existing/potential investors to take their investment decisions in the most profitable manner.

- The stock exchanges have an inbuilt system of taking care of the investors' interest. In the cases of any fraud or default, the investors are compensated appropriately.

2) Advantages to Corporate :

- Through the financial markets, the level of public awareness with regard to the corporate and their activities, (products and services offered by them) is increased manifolds.

- Corporate are given an opportunity to implement various share option schemes for the benefits of their employees.

- Long-term financial support may be extended to needy corporate for the acquisition of fixed assets like land, building, machinery, vehicles, etc.

- Financial markets act as a facilitator for the diversification activities undertaken by a corporate, by permitting sharing of the associated risks in an efficient manner.

- They also act as catalysts for the overall growth of the business sentiments by inspiring and providing appropriate environment for the conduct of business.

Disadvantages of Financial Market

Financial markets suffer from the following deficiencies :

- They lack stability, and as such they are exposed to volatility.

- The investments made by the investors are subject to market risks.

- Financial markets are likely to face 'free-rider problem', a situation wherein no market participant shows his willingness to contribute towards the cost of something; instead everyone hopes that someone else will bear the cost.