Contents :

- Introduction of Business Analytics.

- Types of Business Analytics.

- Tools of Business Analytics.

- Advantages of Business Analytics.

- Categories of Business Analytics.

- Business Analytics with Domains.

- Business Analytics for SMEs.

- Business Analytics Process.

- Relationship of Business Analytics Process & Organization Decision Making Process.

- Business Intelligence vs Business Analytics.

What is Business Analytics ?

Business Analytics is a most trendy technology for business organization. In information technological world organizations used to predict the future events or decision making based on the past records or existing information. For that, Business Analytical Tools are very essential to guide and support for the executives. Not only large scale or multi-national companies, even small and medium size enterprises also can utilize these business analytics tools for their performance improvement. In this conceptual article discusses the different types of business analytics models which can be utilized for taking decision and it brief about the difference between business intelligence and business analytics. Also, this paper discusses about the various types of business analytics in the different domains. The overall purpose of the organization is to attain the goals and objectives and to make profit. It can be achieved if the company is used to analyze their business process through business analytics. Business analytics provides the models and procedures to Bl (Business Intelligence). It also involves tracking data and then analyzing them for competitive advantages. Business analysts started to get employed to assist managers and to take on some analytics roles, especially to make reports. The tools and techniques of industrial engineering and quality control, statistics and operations research, were developed and used by a diverse set of practitioners who provided advice to organisations Business analytics practitioners treat this as their professional lineage.

The functions of planning, decision-making, providing direction, motivating, monitoring and control are part of a managers' job. Business analytics makes extensive use of data, statistical and quantitative analysis, explanatory and predictive modeling, and fact-based management to=drive decision making. It is therefore closely related to management science. Analytics may be used as input for human decisions or may drive fully automated decisions.

Types of Business Analytics :

We live in an environment where every second the sum of data generated goes up. When processing such a large amount of data, it’s only normal to have resources that will help us manage all of this stuff. Raw data also reflects a mass of unstructured knowledge. Data analysts use their skills to extract statistically meaningful data knowledge. It is here where multiple types of business analytics come into action. Business analytics are of following types :

1) Descriptive Analytics :

Descriptive analytics provides simple summaries about the sample and about the observations that have been made.

Descriptive Analytics deals with his historical data with clustering, scorecards and reporting. It answer the question like ‘what has happened?’ It uses data mining techniques and data aggregation to make available insight into past.

2) Predictive Analytics :

Predictive analytics encompasses a variety of techniques from statistics, modeling, machine learning, and data mining that analyze current and historical facts to make predictions about future, or otherwise unknown, events. Predictive Analytics is a division of high level analytics which is used to predict future actions.

Predictive Analytics employ predictive modeling by using machine learning, statistical techniques, data mining, modeling and artificial intelligence. "It's looking at the past performance of whatever you are trying to analyze, understanding the present, and applying that past to the present to predict the future", says Fred Shilmover, CEO, Insight Squared.

3) Prescriptive Analytics :

Prescriptive analytics automatically synthesizes big data, multiple disciplines of mathematical sciences and computational sciences, and business rules, to make predictions and then suggests decision options to take advantage of the predictions. Prescriptive analytics recommend decisions using optimization, simulation etc. Prescriptive Analytics recommends decision making by using optimization, simulation, etc. It answer the future based question like ‘what should we do now?’ Prescriptive Analytics used simulation and optimization modeling techniques to analyze future based questions. It gives different possible actions and guide the organization towards solution.

4) Decisive Analytics :

This supports human decisions with visual analytics the user models to reflect reasoning. Decision Analytics supports end-user decisions with data visualization which the user models to reflect reasoning. Decision analytics allow business firm to convert data into important business decisions. Using decision analytical tools, scoring models and software applications to assess data, analytics help businesses. It manages credit risk, prevent fraud, target marketing offers and automate decision making. Decision analytics proficiency cross-over a variety of industries, including banking, telecommunications, insurance, automotive, retail finance, public sector, small business and unsecured lending.

Tools of Business Analytics :

Business analytics is a fast growing field and there are many tools available in the market to serve the needs of organizations. The range of analytical software goes from relatively simple statistical tools in spreadsheets (e.g., MS Excel) to statistical software packages (e.g., KXEN, Statistical) to sophisticated business intelligence suites (e.g., SAS, Oracle, SAP, IBM among the big players). Open source tools like R and Weka are also gaining popularity. Besides these, companies develop in house tools designed for specific purposes.

Here is a list of eight most popular analytic tools used in the business world :

1) MS Excel :

Excel is an excellent reporting and dash boarding tool. For most business projects, even if one run the heavy statistical analysis on different software but one will still end up using. Excel for the reporting and presentation of results. Excel can handle tables with upto 1 million rows making it a powerful yet versatile tool.

2) SAS :

It is the most commonly used software in Indian analytics market despite its monopolistic pricing. SAS software has wide ranging capabilities from data management to advanced analytics.

3) SPSS Modeler (Clementine) :

SPSS Modeler is a data mining software tool by SPSS Inc., an IBM company. It was originally named SPSS Clementine. This tool has an intuitive GUI and its point-and-click modelling capabilities are very comprehensive.

4) Salford Systems :

It provides a host of predictive analytics and data mining tools for businesses.

The software is easy to use and learn.

5) KXEN :

It is one of the few companies that is driving automated analytics. Their products are easy to use, fast and can work with large amounts of data. Some users may not like the fact that KXEN works like a 'black box' and in most cases, it is difficult to understand and explain the results.

6) MATLAB :

It is statistical computing software developed by MathWorks, MATLAB allows matrix manipulations, plotting of functions and data, implementation of algorithms and creation of user interfaces. There are many add-on toolboxes that extend MATLAB to specific areas of functionality, such as statistics, finance, image, processing, bioinformatics, etc. MATLAB is not a free software. However, there are clones like Octave and Skylab which are free and have similar functionality.

7) R :

R is a programming language and software environment for statistical graphics. The R language is an open source tool and is widely used by the academia. For business users, the programming language does represent a hurdle. However, there are many GUIs available that can sit on R and enhance its user friendliness.

8) WEKA :

Waikato Environment for Knowledge Analysis (WEKA) is a popular suite of machine learning software. WEKA, along with R, is amongst the most popular open source software used by the business community. The software is written in the Java language and contains a GUI for interacting with data files and producing visual results and graphs.

Advantages of Business Analytics :

- Improving the decision making process (quality & relevance).

- Speeding up of decision making process.

- Better alignment with strategy.

- Realizing cost efficiency.

- Responding to user needs for availability of data on timely basis.

- Improving competitiveness.

- Producing a single, unified view of enterprise information.

- Synchronizing financial and operational strategy.

- Increase revenues.

- Sharing information with a wider audience.

Categories of Business Analytics :

It's been divided these into three major categories as shown in figure below :

Business Analytics with Domains :

The various business analytics domains are available in the information technology sector. These business analytics domains are specifically used for specialization based analytics. - Analytics in Financial Services

- Analytics in Marketing

- Analytics in Pricing

- Analytics in Retail Sales

- Analytics in Risk & Credit

- Analytics in Supply Chain

- Analytics in Talent

- Analytics in Telecommunications

- Analytics in Transportation

- Analytics in Web (Cyber/Internet)

- Analytics in Behavior

- Analytics in Data Collections

- Cohort Analytics

- Fraud analytics

- Visual Analytics

Business Analytics for SMEs :

Over the years, large scale companies are benefited by using business intelligence and business analytics techniques. But, the cost effect for implementing these tools and models to small and medium enterprises is difficult. However, business analytics for small and medium enterprises to give better and accurate result in many ways.

- While implementing the business analytics in the SMEs, it can compete with larger companies.

- It having better business strategy which enables comprehensive and rapid use of business analytics tools across the organization.

- Self-Service business analytics tools for small and medium enterprises also deliver productivity improvements and long term cost savings.

- SMEs are very keen in cost cutting and utilize the latest trendy technologies. Use of mobile app and platform for business analytics to improve efficiency and productivity.

Business Analytics Process :

The complete business analytic process involves the three major component steps

applied sequentially to a source of data (see Figure). The outcome of the business analytic process must relate to business and seek to improve business performance in some way.

The logic of the BA process in Figure is initially based on a question: What valuable or problem-solving information is locked up in the sources of data that an organization has available? At each of the three steps that make up the BA process, additional questions need to be answered, as shown in Figure. Answering all these questions requires mining the information out of the data via the three steps of analysis that comprise the BA process.

The analogy of digging in a mine is appropriate for the BA process because finding new, unique, and valuable information that can lead to a successful strategy is just as good as finding gold in a mine. SAS, a major analytic corporation (www.sas.com), actually has a step in its BA process, Query Drill down , which refers to the mining effort of questioning and finding answers to pull up useful information in the BA analysis. Many firms routinely undertake BA to solve specific problems, while other firms undertake BA to explore and discover new knowledge to guide organizational planning and decision-making to improve business performance.

The size of some data sources can be unmanageable, overly complex, and generally confusing. Sorting out data and trying to make sense of its informational value requires the application of descriptive analytics as a first step in the BA process. One might begin simply by sorting the data into groups using the four possible classifications presented in Table. Also, incorporating some of the data into spreadsheets like Excel and preparing cross tabulations and contingency tables are means of restricting the data into a more manageable data structure. Simple measures of central tendency and dispersion might be computed to try to capture possible opportunities for business improvement. Other descriptive analytic summarization methods, including charting, plotting, and graphing, can help decision makers visualize the data to better understand content opportunities.

Types of Data Measurement Classification Scales :

|

Type of Data Measurement Scale

|

Description

|

|

Categorical Data

|

Data that is grouped by one or more characteristics. Categorical data

usually involves cardinal numbers counted or expressed as percentages.

Example 1: Product markets that can be characterized by categories of

“high-end” products or “low-income” products, based on dollar sales. It is

common to use this term to apply to data sets that contain items identified

by categories as well as observations summarized in cross-tabulations or

contingency tables.

|

|

Ordinal Data

|

Data that is ranked or ordered to show relational preference. Example

1: Football team rankings not based on points scored but on wins. Example 2:

Ranking of business firms based on product quality.

|

|

Interval Data

|

Data that is arranged along a scale where each value is equally

distant from others. It is ordinal data. Example 1: A temperature gauge.

Example 2: A survey instrument using a Likert scale (that is, 1, 2, 3, 4, 5,

6, 7), where 1 to 2 is perceived as equidistant to the interval from 2 to 3,

and so on. Note: In ordinal data, the ranking of firms might vary greatly

from first place to second, but in interval data, they would have to be

relationally proportional.

|

|

Ratio Data

|

Data expressed as a ratio on a continuous scale. Example 1: The ratio

of firms with green manufacturing programs is twice that of firms without

such a program.

|

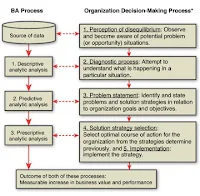

Relationship of Business Analytics Process & Organization Decision Making Process :

The BA process can solve problems and identify opportunities to improve business performance. In the process, organizations may also determine strategies to guide

operations and help achieve competitive advantages. Typically, solving problems and

identifying strategic opportunities to follow are organization decision-making tasks.

The latter, identifying opportunities, can be viewed as a problem of strategy choice

requiring a solution. It should come as no surprise that the BA process described

in Section closely parallels classic organization decision-making processes. As

depicted in Figure , the business analytic process has an inherent relationship to

the steps in typical organization decision-making processes.

The organization decision-making process (ODMP) developed by Elbing (1970)

and presented in Figure is focused on decision making to solve problems but could

also be applied to finding opportunities in data and deciding what is the best course of

action to take advantage of them. The five-step ODMP begins with the perception of

disequilibrium, or the awareness that a problem exists that needs a decision. Similarly,

in the BA process, the first step is to recognize that databases may contain information

that could both solve problems and find opportunities to improve business performance. Then in Step 2 of the ODMP, an exploration of the problem to determine its

size, impact, and other factors is undertaken to diagnose what the problem is. Likewise, the BA descriptive analytic analysis explores factors that might prove useful in

solving problems and offering opportunities. The ODMP problem statement step is

similarly structured to the BA predictive analysis to find strategies, paths, or trends

that clearly define a problem or opportunity for an organization to solve problems.

Finally, the ODMP’s last steps of strategy selection and implementation involve the

same kinds of tasks that the BA process requires in the final prescriptive step (make an optimal selection of resource allocations that can be implemented for the betterment

of the organization).

The decision-making foundation that has served ODMP for many decades parallels the BA process. The same logic serves both processes and supports organization

decision-making skills and capacities.

Business Intelligence vs Business Analytics :

Business Intelligence (BI) is a technology to get the data from internal and external sources of an organization to analyze, process and visualize or present information to the executives for taking good business decisions. The following are the difference between business intelligence and business analytics.

|

Areas

|

Business Intelligence

|

Business Analytics

|

|

Tools

|

Standard Reporting, Visualization, Online Analytical

Processing (OLAP)

|

Statistical and Quantitative Model

|

|

Dashboards

|

Executive Dashboards, Key Performance Indicator

|

Comes along with Business Intelligence

|

|

Analysis

|

Cube Analysis

|

Statistical Analysis

|

|

Queries

|

Drill Down Query

|

Predictive Modeling Query

|

|

Orientation

|

Based on Past Records (Rearview Mapping)

|

Future

|

|

Big Data Compatibility

|

Yes

|

Yes

|

|

Looks

|

Backward Looking

|

Forward Looking

|

|

User/Data driven

|

User-driven demand /action

|

Data-driven decision making

|